The National Insurance Commission (NIC) has allayed the concerns of traders in well-built market structures, such as the Kejetia Market, regarding the insurability of their goods and products even if the market edifice itself is not insured.

The NIC’s assurance aims to dispel misconceptions and encourage traders to prioritise the protection of their investments through appropriate insurance packages.

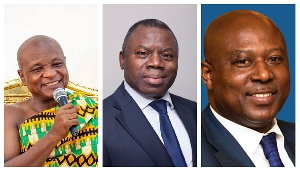

Public Relations Officer-Kumasi City Market Traders Union (KCMTU), Emmanuel Kwarteng, in an interview with the Business & Financial Times (B&FT) expressed concern that the Kejetia Market structure does not currently have insurance coverage.

He noted that several attempts to persuade the facility’s management to insure the market have been unsuccessful.

His worry comes in wake of recent fire outbreaks at Kantamanto, Kwadaso wood-hub in Ashanti Region and Techiman in the Bono East Region.

Mr. Kwarteng explained his belief that insuring individual goods will be challenging if the market structure itself is not insured.

“The facility itself doesn’t have insurance. With insurance, before an individual can get coverage for their goods the facility needs to be insured first, or else no insurance company would want to do business with you. This has been an ongoing issue that we have repeatedly raised with authorities."

“If the market is insured, it will encourage traders to also insure their goods. In the event of a fire outbreak, traders could receive compensation to start afresh. But in a situation where the market itself is uninsured, it becomes difficult for any company to insure individual goods,” Mr. Kwarteng explained.

He recalled a fire outbreak two years ago that destroyed 54 stores as a wake-up call for insurance awareness. “Two years ago, when there was a fire outbreak, we realised the need to do something about insurance. Yet nothing has been done to date.”

Mr. Kwarteng then made an appeal that capable individuals should be appointed to manage the market’s affairs properly.

“We plead with this administration under President Mahama to appoint capable individuals to address these issues. Considering the significant investment in this market, the lack of insurance means traders – not just their goods – are vulnerable,” he said.

However, in an interview Ashanti Regional Head-NIC, Faruk Dramani, clarified that traders do not need the market edifice to be insured before they can insure their goods.

He emphasised that there is no impediment preventing traders from securing insurance for their goods, even if the market structure itself is uninsured.

“During the Kejetia Market fire two years ago, we found that the facility’s insurance policy had expired. While management was negotiating its renewal, the unfortunate incident occurred. Regardless, traders can and should insure their goods. Even if the market is not insured, individuals can still obtain coverage for their items. This way, if there is a fire, traders can make claims to recover their losses,” Mr. Dramani advised.

He also pointed out that the Kejetia Market is a well-built structure, making it eligible for insurance coverage.

“Insurance companies may hesitate to insure markets constructed with wood, but the Kejetia Market’s structure does not pose such risks. Traders should feel confident about obtaining insurance for their goods without worrying about the market’s insurance status,” he added.

Mr. Dramani urged traders to take proactive measures in protecting their goods and emphasised the importance of insurance as a safety-net for unforeseen events.

Watch the latest edition of BizTech below:

Click here to follow the GhanaWeb Business WhatsApp channel

Business News of Thursday, 16 January 2025

Source: thebftonline.com