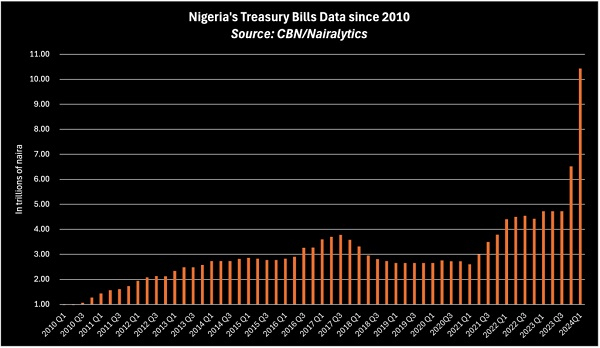

Nigeria has a total Treasury Bills (T-Bills) debt of N10.4 trillion, a 60% rise in just three months, according to data from the Debt Management Office (DMO).

This is the largest T-Bills debt balance on record based on an analysis by Nairalytics, the research arm of Nairametrics, dating back to at least 2010 per central bank records.

The DMO, via the central bank, has issued several Treasury Bills auctions in the first half of 2024 as it relies on a combination of monetary and fiscal policy to fight inflation while also providing a source of funding to meet the government’s short-term expenditure.

Treasury Bills have grown to be a major source of short-term expenditure for the government, especially under the All Progressives Congress (APC), growing from a balance of N2.8 trillion under the Peoples Democratic Party (PDP) government of Goodluck Jonathan to N10.4 trillion currently.

It was N5.8 trillion at the end of the second quarter of 2023, largely accumulated under the Muhammadu Buhari administration.

What the data is saying

According to the DMO, Nigeria’s Treasury Bills balance stood at N6.5 trillion as of December 2023, making up 11% of Nigeria’s domestic debt balance. However, as of March 2024, the figure has spiked by 60% to N10.4 trillion, which is 16% of the total domestic debt portfolio.

This indicates Nigeria’s T-Bills debt is now 4.37% of the Gross Domestic Product (GDP).

According to Nairalytics research, the central bank offered N2.1 trillion in Treasury Bills in the first quarter of 2024. However, it attracted a subscription of N21.7 trillion as investors hungry for yields bided for the one-year bills.

The central bank allotted N5.64 trillion from the total amount on offer. Yields rose to as high as 21.1% in the first quarter of the year as investors rebalanced their portfolios, cycling cash away from equities to fixed-income securities.

Treasury Bills auctions also stepped up in the second quarter of 2024 with another N1.64 trillion expected to be sold. However, the entire amount is maturing bills expected to be rolled over, meaning they will not be repaid but deferred to be paid at a later date.

Tinubunomics’ rising debt profile

The Bola Tinubu administration has relied mostly on the domestic debt market, especially treasury bills, to fund short-term obligations, a huge departure from the Buhari administration, which relied mostly on the Central Bank’s Ways and Means Advances.

The government has faced a significant shortfall in its fiscal revenues, meaning it has to rely on public debts to meet government expenditure obligations. Meanwhile, the central bank under Yemi Cardoso has deployed monetary policy tools such as high interest rates to attract buyers of the Treasury Bills.

The strategy seems to be working, as fixed-income savvy investors continue to oversubscribe T-Bills in nearly all the auctions tracked by Nairametrics. However, critics continue to point to the rising cost of servicing Nigeria’s domestic debt especially Treasury Bills with true yields closer to 30% per annum.

Public Debt Profile on the rise

Meanwhile, Nigeria’s total domestic debt profile rose to N65.6 trillion in Q1 2024, up 11% from the N59.1 trillion recorded as of December 2023. The external debt profile dipped from $42.9 billion to $42.1 billion within the same period, largely driven by a reduction in Nigeria’s debt to the IMF.

In total, the public debt profile in naira terms is N114.7 trillion, assuming the exchange rate of N1,309 as of March 31, 2024. In dollar terms, Nigeria’s public debt as of March 2024 is $92.2 billion.

Data from the National Bureau of Statistics (NBS) also indicate Nigeria’s GDP is N237.5 trillion based on the immediate last four quarters ending at Q1 2024. This suggests Nigeria’s debt to GDP is now 48.2%, which further means that the country has exceeded its self-imposed debt-to-GDP limit of 40%.

However, the DMO has explained that the surge in total debt in naira terms was largely due to currency devaluation.

In a statement, the debt management agency noted that only about N7.71 trillion was borrowed in Q1 2024 from domestic sources.

What you should know

Nigeria’s rising debt has triggered concerns about the likelihood of higher interest payments, which may consume a significant part of the country’s dwindling revenue.

Moody’s Ratings recently noted that Nigeria’s interest spending may rise by 1% of the country’s GDP, costing about 36% of government revenue in 2024.

PricewaterhouseCoopers (PwC) earlier warned that the continuous increase in debt issuance by the federal government without a corresponding increase in revenue will worsen the country’s debt profile in the long run.

Business News of Thursday, 27 June 2024

Source: nairametrics.com