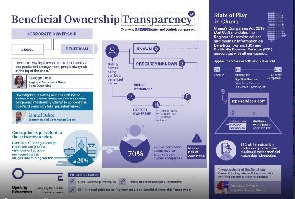

Only 25.8 percent of registered companies have declared their beneficial ownership (BO) information, nearly three months after the deadline requiring businesses to do so, Office of the Registrar of Companies (ORC) has said.

As of February 27, 2023, the ORC said only 74,316, representing 25.8 percent out of the 287,189 registered companies and businesses, had disclosed BO information to it, despite numerous notices to comply with the law.

For failing to comply with the December 31, 2022 deadline, a Principal State Attorney and Assistant Registrar at the ORC, Lysbeth A. Osae, said the over 70 remaining companies, along with some defaulting companies that have also not filed returns in a very long while, are likely to suffer from the ORC’s periodic strike off processes in the coming days.

Speaking exclusively to the B&FT, she said the decision to remove names of defaulting companies from the companies’ registrar is done periodically, adding that “there are public notices issued when it is to take place each time”. However, she said there is no specific date for the exercise.

It would be recalled that the Registrar-General’s Department (RGD), in March 2021, introduced the Beneficial Ownership Transparency Regime as part of the company registration processes under the Companies Act 2019 (Act 992) to ensure companies knew the faces they were transacting business with.

This is in line with the country’s commitments to accelerate beneficial ownership disclosure to promote transparency, curb opacity and disincentivise corrupt practices. In with this goal, the government introduced the new Companies Act (992) in 2019, mandating companies to submit information about their ultimate beneficial owners.

Consequently, a central register was also established in 2020 with ownership data for over 200,000 entities.

A beneficial owner is defined as an individual who directly or indirectly ultimately owns or exercises substantial control over a person or company, according to the Companies Act.

A beneficial owner is also one who has a substantial economic interest in or receives substantial economic benefits from a company, whether acting alone or together with other persons.

The Registrar-General said all companies would be required to submit BO information at the time of incorporation, during the filing of annual returns, and whenever they wanted to make changes to their details.

The initial directive on June 30, 2021 applied to businesses under the legacy data already in existence before the RGD deployed the BO register on October 1, 2020, and that failure to comply attracts sanctions.

More so, new applicants, as of January 1, 2021, were to comply by filling out their BO information and attaching them to their registration documents.

The ORC had said a person who failed to provide the information required or provides false or misleading information to the registrar commits an offence, and liable on summary conviction to a fine of not less than fifty penalty units and not more than two hundred and fifty units or to a term of imprisonment not less than one year and not more than two years or both.

Also, where a company defaulted in complying with the law, the company and every officer of the company are deemed liable to pay to the registrar an administrative penalty of twenty-five penalty units for each day, during which the defaults continued.

Business News of Thursday, 16 March 2023

Source: thebftonline.com