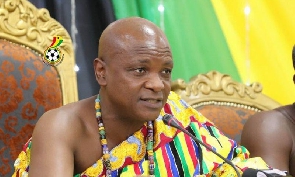

Executive Chairman of World Trade Centre Accra, Togbe Afede XIV, has opined that a part of Ghana’s current economic woes, is due to measures adopted by the Bank of Ghana in its monetary policy decisions.

According to him, the country’s monetary policy regime is a segment of economic policy that he believes has escaped scrutiny over the years.

In an opinion article sighted by GhanaWeb Business, the Paramount Chief of the Asogli Traditional Area said, “the failure of monetary policy to achieve its objectives and targets has been a key part of our problems.”

“The arguments I made in 2003, 19 years ago, are still valid today. Bank of Ghana has indexed its policy rate to past inflation, a self-fulfilling prophesy, with predictable adverse consequences for inflation and the value of the cedi,” he noted.

He further raised concern over the current monetary policy rate of 27 percent which was recently announced by the Central Bank.

"By this dogmatic interest rate policy, BoG tried to keep its policy rate above year-on-year inflation. I am surprised that today they are happy to fix their policy rate at 27%, below the year-on-year inflation rate of 40.4%, when they have always argued for the opposite."

“It is surprising that the economists at BoG still do not understand that the year-on-year inflation is a historical concept, and that, it is not past price changes that interest rates must seek to compensate for,” the economist added.

Sharing his view on how to address the disparity in the inflation rate and monetary policy rate, Togbe Afede called for an adjustment of expected inflation for adjusted seasonality.

"Expected inflation is what astute investors are interested in, much the same way they look at forward price-earnings (P/E) ratios as opposed to trailing P/E ratios in evaluating shares for investment purposes.”

"The Fisher effect, named after Irving Fisher, defines the link between inflation, nominal interest rate and real interest rate, and explains the tendency for interest rates to rise when expected inflation is high and fall when expected inflation is low. Thus, a fall in expected inflation, if the expected real interest rate is unchanged, should cause an equal fall in the nominal interest rate," he explained.

The current economic challenges in Ghana have reached unprecedented levels as citizens, businesses and residents have been grappling to make ends meet in rather turbulent times.

Since the start of this year, the local currency has tumbled by over 50 percent to the US dollar, the cost of living on an upsurge, fuel price hikes, job losses, worker agitations, and general frustration among the Ghanaian populace has been brewing for months.

Ghana is currently seeking a financial bailout from the International Monetary Fund to restore macroeconomic stability, among others.

MA/FNOQ

Business News of Monday, 12 December 2022

Source: www.ghanaweb.com