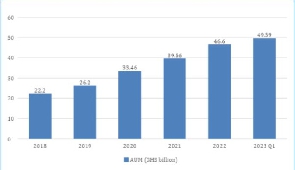

Pension assets under management (AUM) surged to an all-time high of GH¢49.59billion at the end of the first quarter of this year – growing by 6.42 percent from the GH¢46.6billion by the end of 2022, data from the National Pensions Regulatory Authority (NPRA) have shown.

The year-end figure was an 18 percent year-to-year improvement over the prior year’s GH¢39.6billion by end of December 2021. Over the past five years, the annual average growth rate of pension funds under the three-tier pension scheme was 21 percent.

At the end of 2018 and 2019, the AUM value stood at GH¢22.2billion and GH¢26.2billion respectively. It accelerated to GH¢39.6billion at the close of 2021.

This growth, the pension regulator said, has been attributed to several key factors; including an increase in the number of contributors, improved pension literacy, and successful enforcement of the mandatory Tier 2 scheme.

Commenting on the growth of pension assets, Nana Sifa Twum, Manager-Corporate Affairs NPRA, in an emailed response to the B&FT said: “The steady growth of pension funds is a testament to increasing awareness among individuals about the importance of retirement planning and the confidence they have in the pension system. We are delighted to see more Ghanaians actively participating in securing their financial future”.

A closer look at the distribution of assets reveals that the mandatory Tier 1 and Tier 2 schemes hold a significant majority, accounting for approximately 81 percent of the total AUM. On the other hand, the voluntary Tier 3 scheme represents the remaining 19 percent share – highlighting the enduring significance of mandatory schemes in the nation’s pension landscape.

DDEP

Despite the impressive growth, challenges which could potentially impact the pace of future AUM expansion remain. For instance, the non-payment of expected coupons led to a GH¢937million impairment of assets by the end of 2022.

This development poses a potential strain on available funds, as they must be allocated to meet benefit obligations.

“The NPRA has considered reviewing the investment guideline to allow investment in other sectors of the economy,” Mr. Twum added.

In reaction to the effects of the programme, pension funds increased their net position in equities on the Ghana Stock Exchange (GSE), contributing 16 percent to trading activity between January and May 2023 – better than the four percent recorded during the same period of 2022.

Consolidation

To ensure sustained growth and stability, Mr. Twum said, the NPRA is contemplating a series of regulatory tools and policy recommendations for the future. These measures aim to address liquidity issues, enhance stakeholder engagements, standardise accounting treatment, and explore avenues for reducing drawdowns on Provident Fund withdrawals after ten years.

The NPRA is constantly working with the Ministry of Finance to address liquidity concerns and ensure the pension sector’s long-term sustainability. The focus is on promoting targetted stakeholder engagements, standardising accounting practices and exploring innovative strategies to optimise investment opportunities, he noted.

The regulator also plans to encourage stakeholder engagement on moral suasion regarding Provident Funds, thereby fostering greater participation in voluntary schemes. Additionally, a waiver on the enforcement of investment guidelines and the review of custody account cash balance turnaround time will offer flexibility and efficiency to pension fund managers.

Furthermore, the NPRA will consider investment asset swaps between Tier 2 and Tier 3 schemes, exploring avenues for diversification to potentially enhance returns. The introduction of a moratorium on minimum capital requirements for regulated entities will provide relief, allowing them to focus on the effective management of pension assets.

Meanwhile, to mitigate inflation risk and protect the purchasing power of pension funds, the NPRA intends to promote the hedging of investments. This proactive approach will safeguard the long-term financial security of pensioners, he added.

Business News of Wednesday, 12 July 2023

Source: thebftonline.com