The National Pension Regulatory Authority (NPRA) has hinted at a planned operation to clamp down on businesses that have failed to enroll their workers onto the second tier of the new pension scheme.

The NPA is riled at the sluggish attempts by businesses to sign their workers onto the mandatory second-tier pension scheme and wants to embark on an action that will bring defaulting businesses in line with the pension’s law.

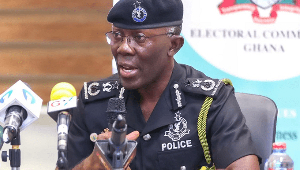

The acting Chief Executive of NPRA, Laud Senanu who was in Tamale earlier this week to sensitise and educate workers on the Pension law, noted that private enterprises have largely defaulted in complying with provisions in the pensions law, which puts workers in a difficult position to access pension benefits under the second tier.

“Most workers -- especially those in the private sectors -- are not enrolled on the pension scheme, therefore making it difficult for such persons to enjoy the benefit after retirement.

“We receive lots of complaints from workers about some difficulties they go through before getting their benefits. Many of such people wait till retirement age before drawing the attention of the authorities, while others too have issues relating to their second-tier benefits.

“Those on the second tier scheme must contact SSNIT to claim their benefits since money is released for that purpose,” he said.

It is estimated that only one in five employers registered with the Social Security and National Insurance Trust (SSNIT) has also signed onto a second-tier pension scheme.

According to the NPRA, even though SSNIT has over 42,000 registered employers, as at February only about 7,200 had registered with second-tier schemes -- which the Authority is worried should not be the case, since the first and second tiers are both mandatory and must have the same number of establishments paying both first-tier and second-tier.

The current three-tier pension system, enacted into law in 2008, demands employers to register their staff under a first-tier basic pension scheme managed by SSNIT and a second-tier work-based scheme that is privately managed. The third-tier is voluntary and includes provident funds and personal pension schemes.

The reforms, which ended the monopoly of SNNIT, were hailed as a major step toward improving the retirement conditions of workers through competition that would maximise the returns earned on pension investments.

It is projected that the reforms will grow assets of the pension industry from GH¢1.06 billion to GH¢5.5 billion over the next four years.

The NPRA has licenced 25 corporate trustees who have responsibility for managing second- and third-tier schemes.

Mr. Senanu advised workers to update their pension records and report any anomalies in their contributions to the authority so they can be rectified in time before retirement and enable them to easily access their pension benefits.

“Pensioners who update their records early before retirement do not go through any difficulty in receiving their pension benefits. It usually takes a month for one to be paid the benefits if the records are valid and prepared earlier,” he added.

Mr. Senanu said efforts are being made to establish offices at the regional and district levels to enable NPRA provide assistance to workers and pensioners.

Business News of Saturday, 16 August 2014

Source: B&FT