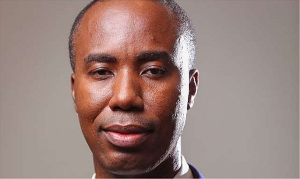

Mr Kojo Mattah, Managing Director (MD) of the Association of Rural Banks (ARB) Apex Bank Limited, on Tuesday, said the Rural/Community Banks (RCBs) sub-sector could not afford to fail Ghana’s rural economy.

This, he said, was because the 144 RCBs with more than 850 branch locations and agencies, were the livewire of the rural economy.

Mr Mattah made the observation in an address read for him by Mr Reuben Adamtey, Manager of the Sunyani branch of the ARB Apex Bank, at the 31st Annual General Meeting of shareholders of the Asutifi Rural Bank at Acherensua in the Asutifi South District of the Ahafo Region at the weekend.

“We cannot afford to do less, because the uniqueness of our locations gives us a comparative advantage over the other banks. Let us keep pushing ourselves so that there would come a time when anytime the name of an RCB is mentioned, all the other financial sector players would begin to catch cold,” he pointed out.

The MD recounted the recent banking sector crisis, and made it clear that RCBs cannot continue to operate in silos.

“We must come together to build a very strong and positive image for the RCBs because that is the only way we can continue to grow together as a family, with endearing values and shared destinies.”

Mr Mattah gave the assurance that the ARB Apex Bank would always stand ready to lead collective efforts “to enhance our image and grow our sector for the teeming shareholders.

Touching on regulating issues, the MD reminded RCBs that the deadline for the notice on “compliance with the minimum paid-up capital for RCBs and Microfinance Institutions” was February 28, 2020, and therefore urged shareholders of the Asutifi Rural Bank to buy additional and more shares to enable the bank meet the required minimum paid-up capital of one million Ghana Cedis.

He advised loan defaulters to pay their debts to the banks so that the pool could be expanded to reach other borrowers without necessarily passing on the cost of default to other customers, thus leading to high lending rates.

“The more the non-performing loan books of the banks keep expanding due to non-payment of facilities, the higher the chances of the cost of default being passed on to other borrowers. Let us, therefore, repay our loans and also in time to help the banks grow their loan portfolios.”

Mr Kofi Agyemang, President of the Brong-Ahafo Chapter of ARB commended the Board of Directors and staff of the Asutifi Rural Bank for their commitment and dedication to duty, and urged them not to be complacent, but to put in more efforts to grow the bank.

He advised staff of the bank to accord customers the necessary respect during their business transactions.

Nana Antwi Kesse Basahyia, Nifahene of the Acherensua Traditional Council who deputized for the Omanhene, Agyewodin Professor Adu-Gyamfi Ampem, urged the shareholders to rally solidly behind the bank to ensure its accelerated growth.

Mr Nicholas Efferh, Deputy Co-ordinating Director of the Asutifi South District Assembly, said the government would continue to protect the interests of financial and other institutions to help develop the national economy.

Alhaji Collins Dauda, Member of Parliament for Asutifi South, urged shareholders and customers of the bank to continue to put their trust and faith in the bank, to enable it to live up to expectation.

Mr Kofi Bonsu Boakye-Boateng, Deputy Brong-Ahafo Regional Minister in the Rawlings Regime, the bank’s shareholder with the highest number of shares, was together with seven others, were honoured for their zeal and determination at placing the Asutifi Rural Bank on a sound financial footing.

Mr Anthony Yaw Oppong, Chairman of the Board of Directors of the bank, was ready to step down because his term of office was to expire at the end of the year. But in a unanimous decision by Management and shareholders, Mr Oppong was asked to stay and continue with his visionary leadership to move the bank forward.

Business News of Wednesday, 1 January 2020

Source: ghananewsagency.org