As though the 550-basis points cut seen in 2017 was not enough, South African-based RMB Research believes the central bank has more wriggle room to further trim its policy rate by between 200 and 300 basis points in 2018, which could trigger aggressive lending rate cuts.

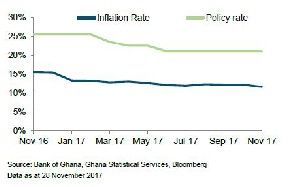

In its reaction to the Bank of Ghana’s 100 basis points cut of the policy rate – which has seen it drop from a high of 25.5 percent in January to 20 percent in November – RMB noted that with inflation resuming its expected southward movement, it is only a matter of time for the policy rate to fall further.

“There is possibly another 200bp to 300bp left in the cutting cycle. We are still of the opinion that inflation will fall within the bank’s inflation target of 6-10 percent in 2018. Moreover, the Bank of Ghana has reiterated its commitment to reducing lending rates for commercial banks.

“The Monetary Policy Committee (MPC) will most likely keep rates unchanged in its first meeting of 2018 (20 January) to assess the festive season’s effects on inflation, before it resumes loosening again throughout 2018,” it noted in its analysis.

RMB is of the view that the rate cut was expected for a few reasons: slower private-sector credit expansion and a tightening credit stance on enterprises could dampen the growth momentum; and inflation resumed its downward trend in October, falling to 11.6 percent, year-on-year from 12.2 percent in September.

“Recent comments by the central bank pointed to a continuation of the cutting cycle. These include focusing on accelerating economic growth and its expression of disappointment in the slow downward pace of lending rates [around 150bp] after cutting the policy rate by 450bp,” it added.

But the BoG’s Governor, Dr. Ernest Addison, urged patience on Monday – saying inefficiencies in the banking sector, particularly the high rate of bad loans, would not allow an immediate drop in lending rates.

“The inefficiencies in the banking sector have to be worked on, and then we can expect that once those efficiencies are made we’ll see a faster transmission of the policy rate into the lending rates,” the Governor said after announcing the 100-basis points reduction in the policy rate to 20 percent.

The Non-Performing Loans (NPLs) ratio declined from 21.9 percent in August to 21.6 percent at the end of October but is still considered too high. Similarly, NPL ratio net of provisions declined from 11.3 percent to 10.5 percent,

According to the central bank’s latest report on lending rates charged by commercial banks, borrowers are still paying above 30 percent to access credit facilities – although the cost of lending, since turn of the year, has declined by about two percent.

‘It could take late 2018 for interest rates to ease’

Meanwhile, a banking academic, Dr. Richmond Atuahene, has said the “cautious” posturing of the central bank means it could take as long as late 2018 or even early 2019 for lending rates to respond to lowering of the policy rate, urging the public not to be too optimistic too soon.

Speaking to the B&FT, Dr. Atuahene – who is a former Faculty Head of Banking Operations at the National Banking College – said the Governor’s cautious tone points to uncertainties that remain in the macroeconomy as well as on the global level, which is why the policy rate was not cut significantly.

“If it [lending rates] will come down, then we should look at late 2018 or possibly early 2019 when we can be sure inefficiencies of the banks will be minimized, and when we will be sure about the economic performance and its indicators,” he said.

“The Governor said the rate can come down only when the high non-performing assets are looked at; and then he even went to a position where he said it is dependent on the global economy. And here he is talking about oil prices, which have moved to US$64 per barrel. And also looking at commodity prices, cocoa continues to decline. So, therefore, it will affect the exchange rate market,” he said.

“He again said that if the interest is to drop, banks must address the inefficiencies on the loan. So being cautious, he is not going to drop the policy rate because he is not certain about inflation; he is not certain about the currency stability, and he is not certain about the global economy,” Dr. Atuahene opined.

“So, as for interest rate,” he said, “we shouldn’t expect it coming down soon because the governor himself has said he is not certain about the global economic fundamentals; he doesn’t know the direction that cocoa and oil prices will take. So, if he cuts the policy rate by a high margin and prices of the commodities rise sharply, it will create a problem.”

Business News of Sunday, 3 December 2017

Source: thebftonline.com