RANDGOLD’s formal offer for Ghana’s Ashanti Goldfields Company Limited could emerge as early this week, stepping up a bidding war between the London -based gold miner and South African giant AngloGold, a sources said on Friday.

The source said Randgold and Ashanti were close to finishing their mutual due diligence and that an offer could come early this week.

They were supposed to give a firm offer at the end of the week, so that Ashanti’s board would meet to discuss the offer, a source told Reuters.

The source added that he expected Ashanti’s board would consider the rival bids for the next couple of weeks and then pass their recommendation to the government by October. Randgold kicked off a bidding battle for Ashanti, Ghana’s prized asset, when it proposed a ?1.46 billion all-share bid only days after Ashanti had accepted a $1.1 billion bid also consisting of stock from AngloGold.

But so far Rangold’s offer has only been an indication of interest and all eyes have been on the company to see when it would submit a formal bid.

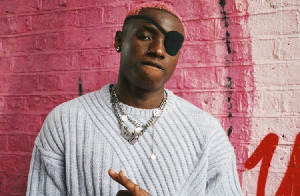

We are planning to complete this process,” Randgold’s Chief Executive, Mark Bristow told Reuters on Friday, when asked if his firm would definitely place a firm offer.

“We are all very mindful of getting it done sooner rather than later,” he added. His comments came a day after Ashanti’s Chief Executive, told Reuters the company’s board- not the Ghanaian Government- would make the final decision on which offer to go with.

“It isn’t the case that the Ghana Government is going to make the decision.... The golden share will not be used for this purpose ,” AGC CEO told Reuters, referring to the government’s right to block any take-over of the Ghanaian company.

The comments, which echoed those of the Ghana government the day before, were seen as significant as most analysts and observers had believed that the government would have the ultimate say over Ashanti’s future.

As well as holding the golden share, Ghana also holds 17 per centstake in Ashanti and sources close to the process have said the government will want to retain as much control aspossible.

Investors have however, so far been cool on Rangold’s offer, saying the mining company is too small- it is half Ashanti’s size and lacks experience and cash. “ We have demonstrated more than enough that we are serious about this, Bristow said.

We have very experienced people and we understand how to do business in a global sense,” he added.

Click to view details

Business News of Monday, 22 September 2003

Source: Reuters