We serve as media consultants for Bright Simons, a honorary Vice President at IMANI Africa and a frequent collaborator of ACEP, both think tanks, in which capacity we issue this public statement.

We have observed with dismay what appears to be a coordinated public relations campaign to discredit our client by Fidelity Bank Ghana Limited (“Fidelity”) and the Electricity Corporation of Ghana (“ECG”).

If it was the intention of Fidelity to engage in a public debate with our client, the ethical and professional thing to do would have been to withdraw their pending libel lawsuit against him so that all sides can speak freely and robustly about the issues in the press. Promoting one-sided commentary in the press is not the professional and ethical approach in this circumstance.

Our client has been careful and diligent in his public commentary till date to avoid prejudicing the case, but the ongoing attempt to foist a one-sided perspective compels us to respond to specific factual mischaracterisations.

The context in which our client publicly questioned ECG about its foreign exchange (FX) dealings is key to appreciating the situation. ECG had been reported by auditors appointed by its regulators, the PURC, to be hiding information and refusing to cooperate with them to unravel its financial dealings. The organisation had furthermore been charged with procurement irregularities by the Auditor General.

These developments, and the recurrent energy crises that keep engulfing the nation, a situation that many analysts believe can be partly attributed to challenges at ECG, prompted civil society activists and energy analysts at IMANI and ACEP to keep a steady spotlight on ECG, examine its finances, and monitor its procurement activities. It was during this work that ECG’s submissions to the Cash Waterfall Committee came to light showing that the organisation priced each dollar procured for a certain transaction at ~GHS13.95.

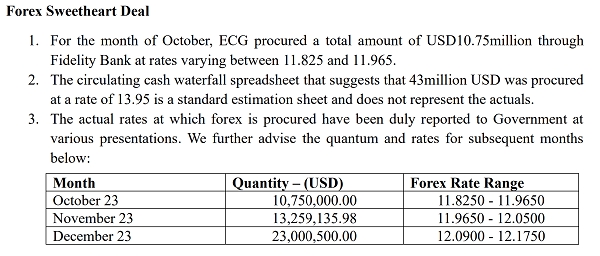

We have noted ECG’s misrepresentation of facts in its recent statement, a portion of which we reproduce below.

The suggestion that the “circulating cash waterfall spreadsheet” (“spreadsheet”) contains an “estimation” rather than the “actuals” implies that our client was either not diligent or attempted to misinform the public. This characterisation is totally false and misleading.

1. The Excel Workbook from which the information was found is an official document of the Cash Waterfall Mechanism Committee.

2. The spreadsheet in question was prepared from information supplied by the Finance Directorate of ECG.

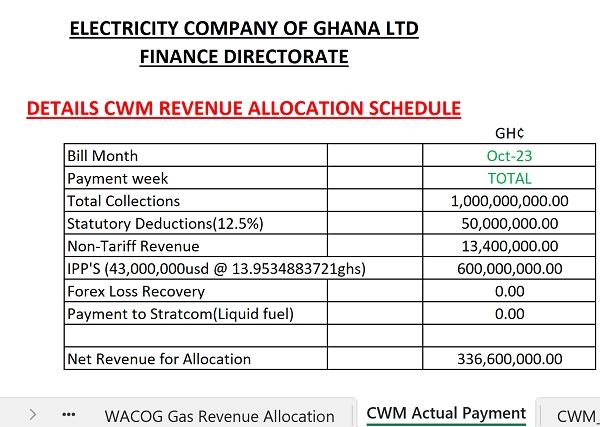

3. The spreadsheet contains multiple entries. The spreadsheet is titled CWM Actual Payment (emphasis on “actual”). For transparency, we reproduce the relevant section of the document below.

4. It is clearly indicated in the highlighted page that ECG’s unit procurement cost for 600 million GHS was ~GHS13.953/$1.

5. The billing month is indicated clearly as October 2023.

6. The amount indicated - US$43 million – corresponds exactly to the amount of money the government and ECG have announced publicly that they are paying the Independent Power Producers (IPPs) monthly. (See: https://gna.org.gh/2024/02/government-targets-us1-9bn-savings-in-energy-sector-debts-restructuring/ re: “This has led to a monthly payment of US$43 million, instead of US$77 million”.)

7. Fidelity is the acknowledged single account operator of ECG and has been the main FX broker for ECG at various times.

8. Nothing in the spreadsheet suggests that the figures and other entries are merely hypothetical. On the contrary, the document was in use as late as February 2024 as part of reconciliation exercises relating to past payments already made by ECG.

Our client did not pluck these numbers from the air. He did not concoct them. As an analyst he was entitled to draw fair and analytically sound conclusions from official, public, documents, which he did.

Whilst ECG and Fidelity have made various claims about what happened, their claims clearly contradict the official CWM records. Only a deep forensic audit by a reputable team of auditors can effectively resolve these contradictions.

What is before the court however is a libel lawsuit that alleges that our client knowingly made false and misleading claims to tarnish the reputation of Fidelity. Lawyers of our client intend to contest this allegation vigorously.

Our client has explained his motive for questioning whether the ECG – Fidelity transactions were arm’s length or tainted by insider dealing, as hinted in his post on X (formerly known as Twitter). Further expatiation is strictly a matter for trial.

For the sake of completeness, we are providing a link to our client’s article detailing this conflict of interest, which is highly germane to his motive for questioning the financial soundness of ECG – Fidelity transactions.

Link: https://brightsimons.com/2024/03/20/the-people-vs-fidelity-bank-of-ghana/

Our client disclosed that a close relative/associate of the Chief of Staff of Ghana’s President serves as the Head of Legal at Fidelity Bank. In that role, she negotiates and/or clears some legal transactions involving the two corporate entities on both ends. This “politically exposed person” undertakes activities at ECG, including corporate initiatives, that go beyond her board remit. ECG’s statements on this affair therefore lack candour and evade the issues of insider dealing.

In deference to the court, we hope that Fidelity Bank and ECG shall not provide our client with occasion to publicly defend his professional integrity in this manner again while this suit is still pending.

Given the serious public interest dimension of this case, it is our hope that all parties will cooperate in good faith to ensure a smooth and civil trial. In the meantime, we urge all editors to give this statement the same level of prominence being given to the circulating ECG and Fidelity documents.

Issued by:

LinkStar AS

Fidelity Bank sues Bright Simons for defamation, demands GH¢20m in damages

Business News of Friday, 5 April 2024

Source: LinkStar AS