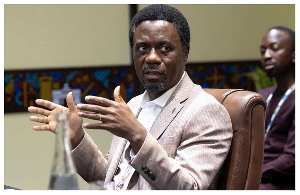

The Chief Executive Officer, eTranzact Global, Valentine Obi, has urged central banks and economic policy decision-makers to consult key market players and consider market sentiments in their decision-making process to ensure balanced policies inclined with players’ perspectives.

He reiterated that policies play a crucial role in fostering financial sector growth and central banks as the torchbearers of formulating regulations and policies for the sanity of the financial space and overall economic growth must consider market perspectives and take feedback in their decision-making process.

“There needs to be more interaction between the banks, regulators, and Fintechs. The regulator is the one that guides everyone but it’s also important that the market operators are involved in developing some of the regulations because if you create regulations that stakeholders are involved in, the market itself would force players to apply it making the work of the regulator even easier.

“The central banks, therefore should not see themselves as they know it all. There is a need for them to listen to the market.

The consideration should always be about what is the risk we want to address and how we use the market operators to develop some of the solutions to the challenges,” he said.

He made these remarks at the 2024 3i Africa Summit held in Accra, during a panel session under the theme: “Banking and FinTech Intersection: Balancing Innovation, Risks, and Inclusion.”

The panel considered the digital economy policies in Africa, as seen through the lens of industry leaders, as a delicate balance between fostering innovation, managing risks, and promoting inclusion.

With a focus on the perspectives of the current policy landscape, the challenges Fintechs and financial institutions alike face, and the strategies they employ to navigate this dynamic environment, Mr. Obi emphasized that some policies force players to find means of survival, however, ultimately, central banks must make decisions that are in the best interest of the total economy and the success of the market players is the success of the general economy.

Banking sector must be receptive to future fintech disruptions

Mr. Obi further urged the banking sector to remain receptive to future fintech innovations to meet the evolving needs of customers.

He underscored the importance of upholding the current relationship and trust among banks, fintechs, and mobile money providers highlighting that it was an unmanageable task to get banks to accept Fintechs disruptions initially hence now that there seems to be greater collaboration, the need for sustainability cannot be overemphasised.

Fintech innovations such as mobile banking platforms, digital wallets, blockchain technology, and artificial intelligence have the potential to continuously revolutionize the way banking services are delivered.

He explained that Fintechs have different mindsets to that of banks, therefore banks need to adopt and collaborate with fintech companies to leverage these innovations for the benefit of both parties and customers.

“As Fintech entrepreneurs, our thinking is slightly different. We are thinking about potential and opportunities while banks are thinking about risk and control of assets because they need to be very careful about customers’ money.

“The necessity here is how we merge these two. My understanding of the banks is that when they don’t understand the solution you are bringing properly, they quickly inform management that it is risky and once management hears that something is risky from the evaluation team, that option is completely shut down,” he said.

However, over the years banks have come to understand how relevant some of these solutions are and are now driving digital financial systems which is a good phenomenon, he added.

Business News of Monday, 20 May 2024

Source: thebftonline.com