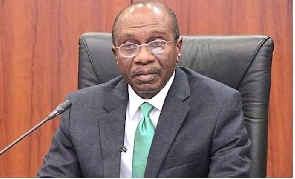

Some financial experts have said that the suspension of the Governor of the Central Bank of Nigeria (CBN), Mr Godwin Emefiele, is a good step that would stabilize both the capital market and the foreign exchange market.

Reacting to the development during an exclusive chat with Nairametrics, the past president of the Chattered Institute of Bankers of Nigeria (CIBN), Mr. Okechukwu Unegbu, said it was a step in the right direction.

According to him, the removal of Emefiele as CBN Governor will help stabilize both the capital market and the foreign exchange market.

“Emefiele’s removal will impact positively on the capital market and the foreign exchange market, where he maintained multiple exchange rates. The multiple exchange rates hurt the economy.”

He accused Emefiele of refusing to accept wise counsel from experienced, former bankers.

“His undoing was that he ignored the counsel of old and experienced bankers; he was so sure of his programmes and policies,” he said.

Suspension Will not Impact Market Negatively

The Managing Director of Crane Securities Limited, Mr. Mike Eze, said market will remain stable until the investigation concludes and provides sufficient information to inform market reactions.

“The CBN is the highest financial institution in the country and the governor works with about three deputies who help him in fashioning out policies and most of these policies were hijacked by politicians. So, most of his policies were politically motivated.

“Politicians are the ones that destabilise the economy, not Emefiele. The capital market does not react on hearsay, the market will have enough information before reacting, so, I believe the market will be stable until the outcome of the investigation,” he said.

Expectations for Improved Market Performance and Forex Boost with Emefiele’s Exit

the Executive Vice Chairman of Hicap Securities Limited Mr David Adonri, said even though the secondary market benefited from Emefiele’s policies, the primary market did not. He said:

“The impact on the secondary market was impressive but there was no impact on the primary market which has remained inactive. We hope that his exit will bring a much-needed positive impact on the primary market and further boost the secondary market.”

Adonri further stated that it is expected that Emefiele’s exit and the fulfilment of Tinubu’s campaign promises for the economy will help boost the forex market.

“Those factors are less importation and more exportation and more capital inflow either through direct investment, portfolio investment, or diaspora remittances.

“However, if the multiple exchange rate regime run by Godwin Emefiele is discontinued and replaced by a single forex regime, that can assist the forex market to boom,” he said.

What you should know

Nairametrics reported that President Bola Tinubu has suspended the Governor of the Central Bank of Nigeria, Godwin Emefiele, with immediate effect. This was disclosed in a statement by Willie Bassey, the Director of Information for the Secretary to the Government of the Federation.

Mr. Emefiele has been directed to immediately hand over the affairs of his office to the Deputy Governor (Operations Directorate), Mr. Folashodun Adebisi Shonubi, who will act as the Central Bank Governor pending the conclusion of the investigation and the reforms.

Business News of Monday, 12 June 2023

Source: nairametrics.com