Founder and Chief Executive Officer of Groupe Ndoum, Dr. Paa Kwesi Nduom, is demanding that the government settle a debt of GH¢7.1 billion owed to his defunct GN Bank.

As part of the banking sector clean-up and reforms conducted by the Bank of Ghana in 2017, GN Bank became insolvent after the apex bank discovered a number of breaches.

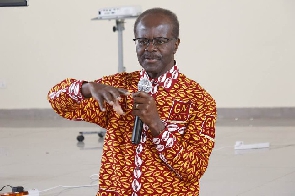

Addressing journalists at a press briefing, Dr. Ndoum is demanding a structured repayment plan on loans used to prefinance government projects in order to restore his financial institution and repay depositors and creditors whose funds have been locked up.

Dr. Paa Kwesi Nduom further appealed to the government to restore the banking license of GN Bank, which he believes was a thriving financial institution.

“We [Groupe Ndoum] understand the importance of infrastructure development in this country. We decided that the country needs it the most, and if nobody’s credit is good, that should not include the government because its credit must be good,” he said.

Dr Ndoum continued, “We [Groupe Ndoum] financed cocoa roads, which used to be the safest activity you could engage in. We invested in schools and other key projects across the country, and it's funds from our companies that prefinanced these projects. The government owes us a debt of GH¢7.1 billion, and if they had paid that amount to contractors about six years ago, there wouldn’t be a Gold Coast/Black Shield, GN Bank problem. We are demanding that the government pays us the monies owed.”

He added that at the time the projects were prefinanced, there was an expectation that government loans were deemed as low risk, hence repayment would be prompt.

As part of the banking sector clean-up exercise, GN Bank was closed down by the Central Bank after it cited insolvency and poor governance issues as the reason.

GN Bank Collapse: Dr. Paa Kwesi Ndoum demands govt release his company's license. #JoyNews pic.twitter.com/lLaJFoqYjS

— Joy 99.7 FM (@Joy997FM) May 26, 2024

MA