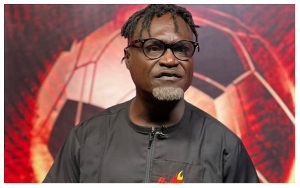

Republic Bank of Trinidad and Tobago (RBTT) cannot take over HFC Bank anytime soon, Managing Director of HFC Bank Asare Akuffo has stated categorically.

In an interview with the B&FT, he stated that both sides (HFC Bank and Republic Bank) have an agreement which stipulates that Republic Bank will not go further than 40 percent. Currently, Republic Bank has a 32 percent stake in HFC Bank.

“I don’t expect Republic Bank to take over HFC anytime soon, because we have agreed that they can get a maximum of 40 percent.

“More so, the Bank of Ghana (BoG) has written to them and the Securities and Exchange Commission (SEC) that in the meantime it will not allow Republic Bank to go beyond 40 percent; so I can stand on that and say that they are not going to have a majority in HFC in the near-future.

“From the board and management of HFC we want to create a partnership between a foreign investor (Republic Bank) with strong local partners like SSNIT, Ghana Union Assurance, and COCOBOD (HFC major shareholders),” he said.

Mr. Akuffo said that he hopes HFC remains a private bank,as sometimes there is a limit to the level of private capital available in the country, so bringing foreigners in helps maintain the private-sector profile.

“SSNIT could provide all the money, but then HFC would become a de-facto government bank; and with the experience in this market, it is not the best way to go. So it is a partnership we are hoping to build, so that both sides make money.

“It is not the plan of management that the bank will be sold completely to Republic Bank, or for them to have a large stake that would make local participation insignificant. I think that as a country this is the kind of thing we should be doing.”

He noted that looking at the value of HFC, Republic Bank will want to acquire more than the stipulated 40 percent -- but that cannot happen unless SSNIT, COCOBOD and Ghana Union Assurance sell their stake, which is currently unlikely. “I would be surprised if any of them wants to sell.”

Republic Bank Limited in a statement issued in Accra and signed by Mr. Robert Le Hunte, the Country Manager for Ghana and sub-Saharan Africa, and copied the B&FT, said it is prepared to make an offer for all the remaining shares in HFC Ghana if push comes to shove.

“Republic Bank continues at this time to engage in discussions with the SEC and the Bank of Ghana regarding the possibility a waiving the mandatory offer, but is prepared and able to make an offer for all of the remaining shares in HFC Bank should it be mandated to do so by the regulators,” the statement said.

“Republic Bank's collaboration with HFC has from inception been cordial and open, and continues to be so as it seeks to add value to the latter bank's offerings and ability to serve the needs of the Ghanaian public. Republic Bank has a proud legacy of service in all markets which it serves; and every acquisition and merger in which it has engaged created value for all stakeholder, including its customers and the people of the respective country,” the bank said.

The Bank is aiming to replicate its success in financing and playing a significant role in the oil and gas sector and the mortgage market in Trinidad and Tobago here in Ghana.

“Republic Bank has played a significant role in the oil and gas sector in Trinidad and Tobago, and through its investment in and collaboration with HFC Bank intends to bring that expertise and skill to Ghana for the benefit of this country's energy industry and ultimately the people of Ghana,” it said.

“[The bank’s] mortgage portfolio currently stands at more than US$600million in Trinidad and Tobago alone. Republic Bank intends to use its vast expertise in this area to enhance the mortgage offerings of HFC and help to grow that bank's base, to the benefit of the home-owning public in Ghana.”

Business News of Tuesday, 13 August 2013

Source: B&FT

‘Republic Bank can’t take over HFC’