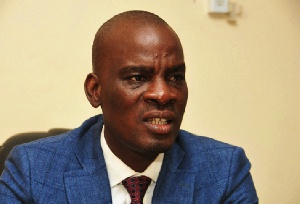

Minority Leader Haruna Iddrisu has backed reforms in the banking sector and urged financial institutions to respect the authority and mandate of the central bank.

According to him, it is in the public interest and to the public good that parliament should be concerned about the banking sector, and employment in the banking sector as well as the consequences of severance and resulting unemployment arising out of the collapse of those financial institutions.

He also added that Ghanaians should be interested as a country as to what can be done to restore the dignity and honour, reputation and standing of financial institutions.

There has been lots of panic, with movement of money from indigenous banks. This worrying sign, Mr. Iddrisu feels, should make Ghanaians concerned about the fate of indigenous banks and their contribution to growth of the economy – the services sector must be jealously and religiously guarded.

“But they must rein them in within rules to respect the regulatory mandate and authority of the Bank of Ghana – and keep it away from unnecessary political interference, so there will be some sanity in the banking sector and banking regime,” he told B&FT in an interview at the hearing of the Finance Committee meeting concerning the banking crisis at Parliament House on Thursday.

To him, the loss of jobs is of particular concern – and whether or not these banks have capacity to pay severance awards to affected persons.

“What happens to the children and wards of affected persons as school reopens, what is it that the government of Ghana can do to find new life for those institutions as much as possible? Don’t forget that the US did it when they had their financial crisis, the state came in; let’s see when the state of Ghana will come in. I generally do not think that we have handled this matter properly,” he added.

Parliament’s Finance Committee has begun a hearing into the banking crisis and has already met with the Bank of Ghana and Ministry of Finance on Wednesday; KPMG, PwC and Consolidated Bank Ghana Limited will take their place on Thursday.

The National Insurance Commission and Securities and Exchange Commission are expected to take their turn on Friday.

On August 1st, 2018, the BoG announced its revocation of five banks’ licences – Unibank, Sovereign, Construction, Beige and Royal Banks – and subsequently transferred all deposits, selected assets and liabilities of those banks to a newly-created entity: Consolidated Bank Ghana Limited.

The action follows the withdrawal of banking licences from UT and Capital Banks a year ago, and their subsequent take-over under a purchase and assumption arrangement with GCB.

Click to view details

Business News of Friday, 7 September 2018

Source: thebftonline.com

Respect mandate of BoG – Haruna Iddrisu

Entertainment

CEO of Caveman Watches ties the knot in private ceremony

Opinions