Findings of investigations into alleged criminal acts that led to the collapse of some banks in country will soon be made public, President Nana Akufo-Addo has assured Ghanaians.

Insolvency arising out of mismanagement and misappropriation of funds as well as bad institutional governance among other factors caused the Bank of Ghana to revoke the licences of some nine indigenous banks.

Also, some microfinance, saving and loans companies, as well as other investment houses, have also been closed down on similar grounds

Though some heads and top management of these institutions have since 2017 when the exercise started, are being investigated for possible criminal acts which the central bank believes contributed to the collapse, not much have been heard of the cases.

Some Ghanaians have been pushing for persons behind the collapse banks to be prosecuted.

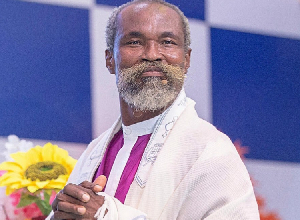

Delivering his 2019 Christmas message to Ghanaians on December 24, President Nana Akufo-Addo assured that all persons found culpable will be dealt with according to the law without fear or favour.

“Investigations into potential criminal conducts are proceeding as it appears there has been massive diversion of assets of these financial institutions.

“I assure you the outcome of these inquiries will be made known very soon as well as the actions that will be taken to bring those responsible to book.”

The President said inasmuch as the action to close down the banks and savings and loans institutions was a difficult one to do, it inures to the benefit of depositors at the end of the process.

“We’ve had to take painful but necessary measures to sanitize and save the banking system; a process which I know has brought discomfort to many household,” he stated.

“It is worthy to note however that the jobs of some 6, 500 workers were saved as a result instead of the 10, 000 that could have been lost in addition to the protection of funds of 4.6million depositors,” Nana Akufo-Addo pointed out.

He noted the Finance Ministry and the Bank of Ghana have worked together to guarantee payment of 100 per cent of deposits of customers of the failed banks.

“I’ve directed the Ministry of Finance to work with the Bank of Ghana to ensure the same applies to customers of microfinance and savings and loans companies whose licenses have been revoked,” he said.

The President has meanwhile wished Ghanaians well in their celebration of Christmas, indicating that the coming year will be filled with developmental projects from his government.

He urged the public to be circumspect in their celebration to ensure it is devoid of any accident.

“Let us celebrate the birth of Jesus Christ safely and responsibly and avoid doing anything that will put our lives and the lives of our loved ones and others in harm’s way.”

“Let us be a blessing in the lives of those who need,” the advised.

Year of Return visitors

To the foreign visitors and tourists who are in the country as part of the Year of Return initiative, he said: “I say Akwaaba; our word of welcome to each of you. Ghana is certainly the place to be this December.”

He tasked them to make the most of their stay in the country and ensure they leave with ‘splendid memories’ of Ghana.

Why the banks were closed down

The Bank of Ghana (BoG) in 2017 embarked on a comprehensive reform agenda to strengthen the regulatory and supervisory framework for a more resilient banking sector.

While some banks had their licences revoked, others have been merged for their inability to raise the new 400 million-cedi minimum capital requirement as of December 31, 2018.

For other banks, the central bank revealed acquired their licences fraudulently and through the use of non-existent capital.

In the midst of the revocation of licenses and the collapse of these banks, the government established the Consolidated Bank of Ghana in which assets and liabilities of seven collapsed banks were transferred.

Consolidated Bank born

In all, seven banks- UniBank, The Sovereign Bank, The Beige Bank, Premium Bank, The Royal Bank and Heritage Bank, have been consolidated.

At the end of the two-year reform, only 16 banks were able to recapitalised successfully while three merged with five banks receiving bailouts from the government. One bank exited the sector voluntarily.

This has brought the total number of universal banks in the country to 23 from the previous 33.

Business News of Tuesday, 24 December 2019

Source: 3news.com