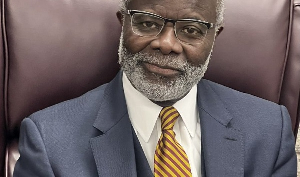

The Global Chairman of Groupe Nduom and owner of the defunct GN Bank, Dr. Paa Kwesi Nduom, has made a passionate appeal to the Governor of the Bank of Ghana (BoG), Dr. Ernest Addison, to evaluate new evidence and reinstate the banking license of GN Bank.

Dr. Nduom maintains that his bank is ready to function and resume operations fully and called on the central bank to maintain the assets of his bank in good condition.

He believes that the bank’s assets are extremely viable and have the potential to thrive if the BoG reinstates its license.

“So, when people ask what we want, all that we’re saying is to recognize that indeed there was more money there than was said to be—just proof. Recognize the proof. Someone has said somewhere, 'give me new facts and I will change my mind.' We have given and continue to give new facts to the BoG.

“All that we’re asking the Governor, Dr. Addison, is to take a look at the new facts, recognize them for what they are, and give us back our license, give us back our assets. Make sure the assets are in good condition, and let’s move on.

“Even in the reclassified state as a savings and loans company, we are prepared to start working. And we know once all the accounting is done, once the funds start coming in, everybody will realize that the 305-branch network of GN Savings deserves to become a universal bank—GN Bank again,” Dr. Nduom explained in a video shared on Facebook.

To prove that GN Bank is ready to fully operate, he listed the requirements for a savings and loans company to operate in Ghana and mentioned that his bank has the capacity to fulfill all the requirements.

He explained, “Even the GH¢30.3 million that the finance ministry erroneously told the BoG that Groupe Nduom companies had. Even if we took that money and paid it, which they still haven’t paid. If they paid us and we paid it into GN Savings, that would have given us the capital required to continue as a savings and loans company. But we said in our books, GH¢2 million.

“In addition, we had properties and other related buildings, including the many branch buildings put up by some of our companies. We said we would give it to the organization to shore up its capital.

“It was all rejected, and these are the same buildings that BoG’s appointed receiver went around hurriedly to put locks on the gates and buildings and walked away. They left them to rot. All of those things are still there.”

In 2017, the BoG’s efforts to consolidate the banking sector led to the revocation of licenses from several financial institutions, including GN Bank.

EAN/MA

Watch the latest edition of BizTech below:

Ghana’s leading digital news platform, GhanaWeb, in conjunction with the Korle-Bu Teaching Hospital, is embarking on an aggressive campaign which is geared towards ensuring that parliament passes comprehensive legislation to guide organ harvesting, organ donation, and organ transplantation in the country.

Click here to follow the GhanaWeb Business WhatsApp channel

Business News of Monday, 24 June 2024

Source: www.ghanaweb.com