As the inflationary environment continued to cool, Ghana’s private sector remained in growth territory at the end of second-quarter 2023. Output and new orders rose again, albeit at softer rates, with employment and purchasing activity also up. Meanwhile, business confidence hit a five-month high.

Softer inflationary pressures were evident with regard to both input costs and output prices, with rates of increase in each easing for the seventh month running.

The S&P Global Ghana Purchasing Managers’ Index™ (PMI) remained above the 50.0 no-change mark in June, and therefore signalled a further improvement of business conditions in the private sector – the fifth in as many months. That said, the index dipped to 50.4 from 51.3 in May; indicating a softer and only marginal strengthening of operating conditions.

In line with the picture painted by the headline index in June, both output and new orders rose at slower rates at the midway point of the year. The rise in activity was the joint weakest in the current consecutive five-month expansion. Where output rose, this was linked to higher new orders and weaker inflationary pressures.

Slower inflation also supported continued growth of new business, which increased solidly again in June. New orders have now risen in each of the past five months.

Softer inflationary pressures were evident with regard to both input costs and output prices in June.

Overall input prices increased at the slowest pace in three years, with both purchase prices and staff costs rising at weaker rates. Purchase price inflation softened amid relatively stable exchange rates. Meanwhile, wage increases generally reflected efforts by companies to help employees with higher living costs.

Weaker rises in input costs fed through to a softer increase in selling prices. The rate of output price inflation eased for the seventh month running to the weakest since February 2021.

Stability, not only of exchange rates but inflation in general and wider economic conditions, supported confidence in the year-ahead outlook for business activity. Confidence strengthened to the highest since January.

Employment increased for the seventh successive month in June as companies responded to new order growth. That said, cost considerations meant the rate of job creation was only marginal and slowest in the year to date.

Purchasing activity was also up, and at a solid pace that was the second-fastest since October 2020. In turn, stocks of purchases accumulated – with firms’ efforts to secure inputs helped by a near-record improvement in vendor performance. Suppliers’ delivery times shortened amid better availability of materials and competition among vendors.

Increased capacity meant that companies were able to deplete backlogs of work at a solid pace, with the rate of depletion sharpest in 2023 so far.

Comment

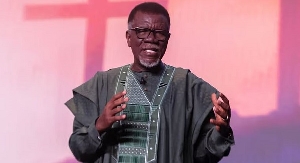

Andrew Harker, Economics Director at S&P Global Market Intelligence said: “Although there were some signs of economic growth in Ghana losing momentum in June, there shouldn’t be too much cause for alarm as output and new orders each increased again at end of second quarter.

“Indeed, a key support to the recovery (a softening of inflationary pressures) showed no signs of coming to an end – with the rate of input cost inflation easing to a three-year low.

“The private sector therefore appears to be in a solid position heading into second half of the year.”

Business News of Thursday, 6 July 2023

Source: pmi.spglobal.com