Societe Generale Ghana, last year recorded an after tax profit of GH¢ 44,605,077.

The Bank, at its 36th Annual General Meeting, in Accra, to discuss its performance for 2015, and to explain the strategies for improvement in the coming years, said its Net Banking Income increased by 11.4 per cent, with the Current Operating Expenses also growing by 26.4 per cent.

The Shareholder’s Funds, it said, appreciated from GH¢221,983,165 to GH¢263,980,201, thus representing a progression of 18.9 per cent.

Based on the performance, the Board of Directors recommended the payment of a dividend of GH?0.076 per share. This translates into a total of GH¢28 million, which is 62.6 per cent.

The shareholders, consequently, approved the amount and also endorsed a number of resolutions.

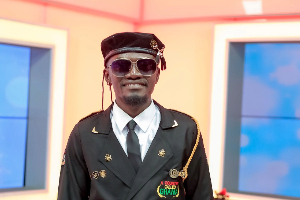

They also approved the appointment of the new Managing Director, Mr Sionle Yeo.

Additionally, the Directors of the Board were re-elected to serve another term of office, while their fees were validated by the shareholders.

On the outlook for 2016, Mr Kofi Ampim, the Board Chairman of the Bank, said: “Societe Generale Ghana is highly confident in the future of Ghana, given the strong economic potential of the country and its sustained peaceful governance.”

He said Ghana’s political stability would be strengthened with yet another successful election to further deepen the country’s democracy.

Mr Ampim said for the Bank, this year would be one of transformation with new systems and processes being put in place to increase its market share with the aim of achieving sustained organic growth.

Mr Yeo, for his part, said there was stiff competition in the industry amidst a challenging economic environment in the year under review, however, the current massive investment of the Institution in a growth strategy, which commenced in October 2015, would define a clear move for a smooth take-off to an ambitious competitive position in 2018.

It would also help to generate more revenue and profitability that would eventually be redistributed to all shareholders.

The Bank, he said, would this year and beyond, invest in the development of its businesses for both its Retail and Corporate customers, improve on its revamped asset, its new growth strategy and the Societe Generale Group’s Leadership Model values.

This would position it to become the preferred Bank because of the professionalism of its teams and its service quality to its customers, he said.

Business News of Tuesday, 5 April 2016

Source: GNA