SMEs across the country have been advised to take up insurance policies to cushion them in case of any eventuality. This was said at an investors’ dialogue organised by TechnoServe Ghana in Accra.

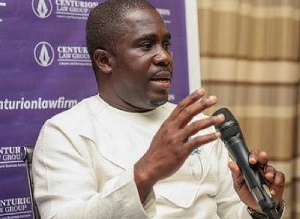

The Agency Manager of Quality Insurance Company (QIC), Joseph Orfson-Offei, said that SMEs should take advantage of the various insurance packages offered them by insurers in order to shield them from losing their businesses in the event of any disaster.

He added that many SMEs shy away from taking insurance policies because of the perception that insurance policies are expensive and will add to their cost of operations. He however opined that policies are there to serve as a protection for SMEs, which will accrue to their benefit in the long-term rather than add to costs.

“All the products insurance companies offer are for SMEs. SMEs are not taking up insurance because they say it is expensive. Rather than seeing it as expensive, insurance is a risk transfer mechanism wthat is meant to protect the assets of businesses,” he said.

Commenting on the general perception that insurance companies are deceitful and do not honour their part of the bargain when it comes to claims settlement, Mr. Orfson-Offei refuted these claims and said that many people make such complaints because they do not read insurance contracts before signing

“Insurance companies are not untruthful. Insurance is a contract, but the issue we have in Ghana is that people sign insurance contracts without reading. And it is the contract that spells out the conditions of the policy. So we entreat the public that if they are signing a contract they should read. We do not make any changes to it. It is the same contract that we follow when paying claims.

“Some believe that we are cheats because we do not readily pay claims the moment it is submitted. But let’s take this example: a business insures a property for GH¢200,000 and pays a premium of GH¢500. In case of any loss the person expects to be paid GH¢200,000. Have you asked where we get the money to pay? We have to use other people’s premium to pay. So we have to do the necessary investigations before we effect any payment, or else we will ruin our business,” he said.

Mr. Orfson-Offei however bemoaned the rate at which people falsify claims with the motive of profiting from insurance, and attributed delays for claims payment to this phenomenon.

“There are always instances when people falsify claims just to profit from us. It is for this reason that we have to take a long time in paying claims because we have to complete our investigations before we pay claims to our clients.

“So we are advising client to show utmost good faith in submitting their claims in order to hasten the process of settlement on our part,” he said.

Business News of Wednesday, 2 September 2015

Source: BFT

'SMEs must take insurance seriously'

Entertainment