A Senior Research Fellow at the Institute for Fiscal Studies (IFS) Dr. Said Boakye has said a faster reduction in the fiscal deficit next year could mean that government will yet again sacrifice its capital expenditure.

The impact of the coronavirus has seen government revising its deficit target for this year from 4.7 percent to 11.4 percent – exceeding the five percent target contained in the fiscal responsibility act which has since been suspended.

Government’s desire to return to compliance with the five percent fiscal rule in the short term means that drastic measures would have to be taken.

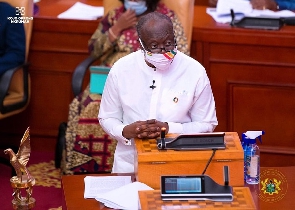

But as Finance Minister Ken Ofori-Atta appeared before Parliament last week to deliver government’s estimates for the first three months of 2021, a lower capital expenditure, among other measures, as a way of bringing the fiscal deficit down to 8.3 percent looked probable.

“It looks like taming the deficit is becoming very difficult and usually what government does is to reduce capital expenditure (Capex). Our Capex in itself is not big, to begin with. If indeed they [government] want to reduce the deficit, CAPEX would suffer drastically,” Dr. Boakye told Business24 in an interview.

Although government projects to spend GH¢13.05 billion on CAPEX in 2021 and GH¢1.9 billion during the first quarter, it has over the previous years failed to meet its own projected expenditure.

For instance, in 2017, government spent about GH¢6.4 billion on CAPEX against a target of about GH¢7.2 billion. During the 2018 and 2019 fiscal years, government spent only GH¢3.33 billion and GH¢4.6 billion, respectively, against targets of GH¢8.53 billion and GH¢6.2 billion.

Other options

According to a senior economist with Databank, Courage Kingsley Martey, the government must explore full all other options available to bring down the deficit.

Mr. Martey said that in order for government to achieve the desired compression in the deficit ratio to GDP, there would be a need for at least three conditions, namely; pick up in revenue performance, containment of expenditure or the sufficient expansion of the GDP base.

Mr. Martey explained said: “if revenue is going to perform, without a significant push in economic recovery, then government may have to scale back on some of its tax reliefs in order to save further revenue losses or maybe even reintroduce some tax handles. But all these tax measures might be coming too early for an already feeble economy which is yet to recover to optimum levels.”

He stated that would mean that the country may have to sacrifice its recovery, hence, pushing back the time the economy returns to full capacity.

“If government also choose to scale back spending, we could face the risk of a relapse in economic recovery because government spending had been a critical anchor for aggregate demand during these uncertain times,” the senior economist said.

Business News of Monday, 2 November 2020

Source: thebusiness24online.net