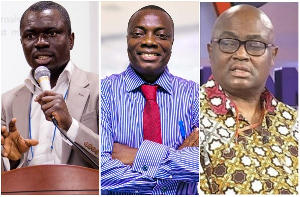

Samuel Fosu-Agyei, a distinguished banker and financial consultant at Prudential Bank, has been sharing his expertise with Seventh-Day Adventist Church congregations in Ghana over the years, demonstrating his extraordinary skills in financial management and treasury.

Mr. Fosu-Agyei addressed the Oyarifa Seventh-Day Adventist District during the Annual Camp Meeting organized by the Meridian Ghana Conference of Seventh-Day Adventists. His presentation during the stewardship hour focused on enhancing financial awareness and highlighting investment opportunities within Ghana’s evolving economic landscape.

His insights come at a crucial time for Ghana’s struggling economy. He advises companies and organizations that, despite the current national challenges, the country’s GDP growth is projected to reach 4% in 2024, with expectations of strengthening to around 5% by 2026. According to him, economic growth is anticipated to be driven by improvements in agriculture, services, and extractive industries.

Drawing from his extensive experience in banking and financial advisory, Fosu-Agyei emphasized the importance of informed financial decision-making. He encouraged the congregation to increase their savings, which is relevant information given the country’s recent economic fluctuations and inflationary pressures.

Prior to this, his financial advisory engagements with the Adventist community on August 12, 2024, also benefitted the Madina District Seventh-Day Adventist Church, where he delivered to the congregation topics on financial independence and investment.

Mr. Fosu-Agyei’s expertise is particularly valuable in the current economic context. Ghana’s banking sector has shown resilience, with assets growing by 33.3% in recent times. However, challenges remain, including a high non-performing loan ratio of 24.1%. In this economic environment, Fosu-Agyei’s guidance on navigating investment opportunities and managing personal finances is especially pertinent and commendable.

As Ghana continues to position itself as a key player in West Africa’s financial landscape, the insights provided by experts like Fosu-Agyei are crucial. His efforts to educate and empower communities with financial knowledge align with broader national goals of enhancing financial literacy and promoting economic growth.

Through these engagements, Samuel Fosu-Agyei is not only showcasing his extraordinary skills in financial management and treasury but also contributing to the financial well-being of Ghanaians.

Click to view details

Business News of Wednesday, 11 December 2024

Source: Foster Acheampong, Contributor