Mr. Atta Yeboah Gyan, the Deputy Managing Director, Responsible for Operations and Support Functions, at Fidelity Bank Ghana has noted that the slowdown in economic growth experienced by the country in the past few years undoubtedly negatively impacts the investment climate and savings culture.

“There is an urgent need for a quick turn-around across all sectors of the economy so to help usher our country back onto the path of sustained growth and national prosperity,” he urged in his keynote address during the 2024 edition of The Money Summit (TMS2024).

These challenges facing the country, including soaring inflation, escalating interest rates, the looming threat of sovereign defaults and the complexities of public debt restructuring, are impacting savers and investors in various ways.

Mr. Gyan explained that the erosion of purchasing power caused by high inflation has compelled savers to either cut down on savings and investment opportunities or seek non-existent high-yielding outlets.

“This is particularly true for fixed income investments, like bonds, and certificates of deposits. The sluggish pace of economic growth is also a major concern for savers and investors. The ongoing threats of sovereign default and public debt restructuring have put investors on edge,” Mr. Gyan said.

According to him, the prevailing domestic economic conditions, the COVID-19 pandemic, conflicts and geopolitical tensions, along with tight financing conditions across the globe, have pushed many of “our compatriots below the poverty line and worsened social inequality”.

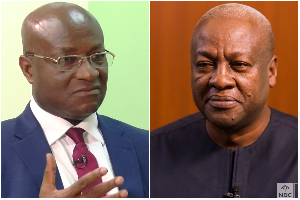

Atta Yeboah Gyan, the Deputy Managing Director responsible for operations and support functions at Fidelity Bank Ghana

“These challenges have compounded the existing problem of low savings and investment culture among Ghanaians. Amid all these, the emergence of financial technology digitalization has fundamentally transformed the landscape of savings and investments, serving as both a disruptor and enabler in several ways,” Mr. Gyan said.

To address the aforementioned challenges, Mr. Gyan advocated for concerted action to revitalise economic growth and restore confidence in the financial markets. He further noted that in the past, many individual businesses focused on short-term gains, often neglecting the long-term impacts of their investments.

“This mindset is no longer sustainable and in the face of these challenges, the traditional investment paradigms no longer suffice. As a result, we need to shift towards sustainable investments that not only provide financial returns but also promote social and environmental wellbeing,” he urged.

Moreover, Mr. Gyan stressed the importance of financial literacy and education in empowering individuals to navigate the complexities of the current economic landscape, asserting that by equipping people with the knowledge and tools they need to make informed financial decisions, “we can enhance resilience and promote prosperity for all”. Themed ‘Investing for the Future: Re-Thinking Investment and Savings to Drive Economic Growth and Development’,

The Money Summit 2024 brought together a heavyweight contingent of financial sector players to brainstorm and provide practical measures to tackle diminished investor confidence and rekindle a mindset of savings and investment.

The summit comes amid concerns about the country’s savings culture, especially as Ghanaians have historically tended to spend a larger portion of their income compared to saving and investing. This low savings rate, currently hovering marginally above the sub-Saharan African average but bettered by some of the regional peers and significantly below the global benchmark, hinders capital development and business growth.

Dr. Godwin Acquaye, the Chief Executive Officer of the Business and Financial Times, stated that the summit’s theme encapsulates the need to collectively reexamine the country’s approach to savings and investment. He emphasised the importance of embracing a paradigm shift that will propel the country towards sustain economic prosperity.

“Despite the overall low savings rates in sub-Saharan African (SSA) countries, both at the national and private levels, there is notable variation across countries. For instance, a study published by the United Nations University World Institute for Development Economics Research and the Institute of Statistical Social and Economic Research (ISSER) in 2022, showed that while Ghana is categorised as a lower-middle-income country, its savings rates do not align favourably with those of its West African counterparts like Nigeria and Cote d’Ivoire,” he stated.

“We must acknowledge the challenges that have tested the resilience of our financial sector,” he said, stressing that the global pandemic and its aftermath have exposed vulnerabilities, urging ethical standards, professionalism and a steadfast commitment to protecting the interests of investors."

The CEO of the Chartered Institute of Bankers, Ghana (CIB Ghana), Robert Dzato also emphasized the crucial role of ethics and professionalism in the financial sector. He stressed the need for character, competence and consequence in building trust and ensuring sustainability.

To achieve this, he called for collective responsibility to build confidence in the investing community. “Trust is a currency in the financial system which plays a catalytic role in development, and businesses should be building relationships, not just transactions,” he stated.

Business News of Wednesday, 24 April 2024

Source: thebftonline.com