Bank of Ghana (BoG) has been asked to simplify the concept of Next-of-Kin for account holders for beneficiaries to easily access benefits.

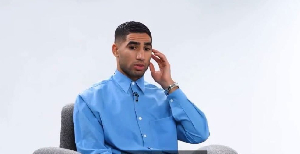

Mr Francis Xavier Sosu, Member of Parliament for Madina, said BoG should not leave issues of Next-of-Kin to the banks to decide on which forms they have to use for beneficiaries.

“We would have to develop a standardised approach across for all beneficiaries. This would require the support of the Office of the Attorney General and the BoG.

We need to make amendments to our banking laws or the Special Depositors Act or set up a new legislative regime that deals with matters like this.

I believe our discussions or deliberations here would bring about a major policy shift when it comes to the Next of Kin regime in Ghana so we can build a better regime in the country.”

The Madina MP was speaking at a High-level Policy Dialogue on reducing family poverty via the use of Next-of-Kin in Accra.

The dialogue was held by Pali Centre for Transformative Society, Atlas Network, Voxtua Legal Services the Madina MP and others.

The dialogue seeks to address research findings on issues relating to Next-of-Kin in reducing family poverty and seek innovations relating to account opening forms by banks when it comes to Next of Kin and addressing the red-tapes and bureaucratic forms of accessing the benefits when relations are passed on.

The research was conducted eight months ago by ILAP and partners.

Mr Sosu said Parliament was currently reviewing PNDC Law 111 and issues raised when it comes to Next-of-Kin were being addressed.

The MP, who is also a lawyer, said access to justice had become a problem especially in the area of the administration of estates, adding the same was also expensive because of the tax component in terms of the property involved.

According to him, sometimes, people who come for such services did not have the means although he would like to offer support to them.

He called for the removal of administrative barriers on Next-of-Kin issues to beneficiaries when filling out bank forms by illiterate people.

People should be made to understand the effects of filling in these forms (bank and pension forms) when they must nominate people who would have to be Next of Kin.

The MP called for the digitization of administrative processes on Next of Kin to reduce the bottlenecks associated with it.

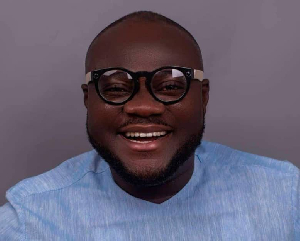

Mr Peter Bismark Kwofie, Executive Director, ILAPI noted that many people were dying intestate through road accidents, floods, fire and rare circumstances.

Mr Kwofie said most of these people who died intestate, leave behind funds in their bank accounts, pension and insurance schemes.

“In many cases when funds of the deceased, including those who died intestate were kept by BoG, insurance and pension firms, worsening the plight of dependents.

The government since the 1970s has capriciously imposed its will on property ownership and transfer of inheritance through burdensome regulations and rightly taken over funds through BoG.”

Mr Kwofie said in the case of financial institutions, pension and insurance firms kept the funds forever.

He said it is incumbent on banks, insurance and pension firms to find out whether account holders or clients were deceased or missing in case an account became dormant.

“They should get in touch with people serving as Next-of-Kin to continue or claim benefits to cater for dependents.”

The BoG’s policy through the Specialized Deposit-Taking Institutions Act, Act 930, 2016 denotes that the banks must contact the next-of-kin of the account holder to find out the whereabouts of Account holders when the account is dormant for three years, but they hardly do.

He noted that the banks before doing that must issue in three months dormant accounts of all account holders.

Mr Kwofie said after five years when the accounts were still dormant, the funds that could liberate families were transferred from banks to the government chest for it to be kept forever.

In the case of insurance and pension schemes, he said they were not required to transfer funds to the National Insurance Commission or any other regulatory authority.

This means that they keep the money to themselves if no one takes legal steps for the claims.

He recounted that accessing benefits or funds also took years, adding that some next-of-kin died while chasing benefits.

Mr Kwofie said it was imperative for stakeholders to address administrative barriers and red-tapeism in assessing benefits.

Mr John Kojo Boateng, General Manager in charge of Benefits, said SNIT paid benefits to survivors within an average of 14 days after death is reported.

According to him, people do not need legal assistance to apply for benefits and SSNIT did not keep the money of members.

He said SSNIT had so far paid GHC488.3 million to dependents of deceased members this year.

The Social Security and National Insurance Trust (SSNIT) has over 1.9 million active contributors.

Business News of Thursday, 30 November 2023

Source: GNA