Importers and exporters in the Small and Medium-scale Enterprise landscape have been urged to position themselves well to attract credit from banks to enable them to benefit from the implementation of the Africa Continental Free Trade Area (AfCFTA) agreement.

In addition, they have been asked to master the Integrated Customs Management Systems (ICUMS) and apprise themselves with other relevant platforms through which they could access information about the free trade agreement and utilise them.

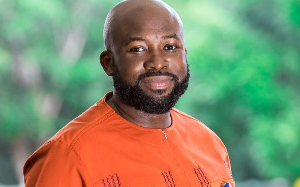

This call was made by the Managing Director of FBNBank Ghana, Victor Yaw Asante during a business forum organised by the Bank on Tuesday on the theme, “Understanding the implementation of AfCFTA for import and export in Ghana.”

The forum saw over 200 participants schooled on the key areas of implementation of the AfCFTA by resource persons from the Customs Division of Ghana Revenue Authority (GRA), and the Ghana Link Network Services (GLNS).

This formed part of activities marking the 25th anniversary celebration of the bank.

They were also taken through the procedure for registration on ICUMS, the role of designated bodies in the implementation of the free trade agreement including the Food and Drugs Authority (FDA), and the Ghana Standards Authority (GSA).

Mr Asante said that the African continent have a US$3.4 trillion economy with 54 countries and urged SMEs had to take advantage of it.

According to him, with the introduction of AfCFTA, the stakes had been raised higher, therefore, “SMEs in Ghana, most importantly, need to secure their registration on ICUMS in order to ensure efficient import and export of goods.”

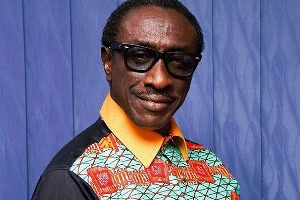

The Group Head of Business Development at FBNBank Ghana, Mr Azubike Obi said the bank had provided a bouquet of financing systems as well as products and services to support the business activities of importers and exporters to enable businesses to tap into the opportunities provided by the AfCFTA.

The range of FBNBank’s offerings which he discussed covered asset products, cash and treasury products, regulatory solutions and advisory services, and local purchase finance/working capital facility, and assured businesses operating as SMEs of the bank’s support especially for importers and exporters.

Business News of Thursday, 25 February 2021

Source: ghanaiantimes.com.gh