Standard Chartered Bank Ghana Limited has recorded a profit before tax of GHC331million in the third quarter of 2017.

The figure represents a 25% growth in profits, compared to the same period in 2016 which the company recorded GHC264million.

The bank in its third quarter 2017 financial results released Tuesday said, they posted a loan impairment recovery of GHC18.1million as of 30th September 2017 compared to an impairment charge of GHC61.5million same period 2016.

During the period under review, Operating expenses was up by only 28% to GHC177.6million as a result of continued focus on the cost management strategy and gains from operational efficiency compared to the third quarter of 2016 which recorded GHC138.5 million.

Meanwhile the underlying operating income increased by 6% to GHC490 million from GHC464million recorded in September 2016, as a result of stable business performance for the bank.

“The effects of the above drivers resulted in increase of pre-tax profit by 25% to GHC331million from GHC264million recorded in same period of 2016,” the bank said in a statement on Tuesday.

Earnings per share for the period increased by 24% from GH?1.61 to GHC2.00 while the average return on equity was 29.67% compared to prior year 29.75%.

The statement further explained that, the growth was possible due to the macro-economic environment having seen relative stability coupled with robust GDP growth during the period under review.

“Capital adequacy ratio for the period is 28.27 per cent compared to 21.59 per cent in prior year,” the statement added.

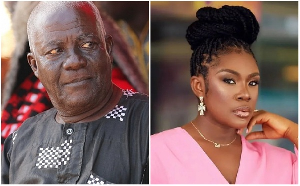

Chief Financial Officer, Kweku Nimfah – Essuman, commenting on the results said, “We have a strong underlying business and we will continue to stick to our strategy of sustaining a diversified balance sheet which remains, structurally liquid and conservatively positioned”.

Meanwhile the Chief Executive Officer, Mansa Nettey who maintains that the bank can meet the set targets for 2017, all things being equal said, “Our results continue to trend upwards as we create shareholder value. Our focus for the rest of the year is to deliver on our strategic priorities whiles investing in the right systems and platforms to drive growth”.

Business News of Tuesday, 7 November 2017

Source: thebftonline.com

Stanchart records 25% growth in profits in quarter three of 2017

Opinions