Managers of the Ghana Stock Exchange (GSE) have hinted at plans to create a derivatives market on the local bourse in a bid to boost liquidity and increase activities on the exchange.

The tentative date set by the GSE to begin trading derivatives on the stock exchange is next year, providing investors interested in shares and currencies a chance to enter into binding contracts for buying or selling the units at a specified price and time in future, helping them better manage risks, hedge, arbitrage and speculate over their future value.

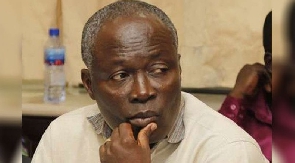

The Deputy Managing Director of the Ghana Stock Exchange, Ekow Afedzie who announced this in Accra last week, has thus encouraged stockbrokers, investment bankers and the investor community to brace themselves for listing of the country’s first derivative instrument on the stock exchange market.

“We don’t have derivatives in Ghana. People try to dabble in derivatives. There is no derivative in Ghana as it is now. But it’s good for people to start learning about derivatives. It’s something that has been in the international world for a very long time. Very soon we will find them being introduced in Ghana. Maybe come next year we will find one or two derivatives being traded on the stock exchange,” he said.

The successful introduction of derivatives on the stock market could make Ghana the first sub-Saharan African country outside South Africa to have a derivatives market.

However, complexity in derivatives could delay the GSE plans as most traders on the stock market are not familiar with their trading mechanisms.

This is evident in Kenya, for instance, where plans by the Nairobi Stock Exchange (NSE) to create a derivatives market have been postponed several times, which the NSE attributed to the need for market players to deepen their knowledge about financial derivatives and also to create public awareness.

Over the past two decades derivatives have become very popular, as the real purpose is to allow traders to maximise returns and simultaneously limit their risk exposure.

However, some investment bankers have warned that derivatives, though a good tool to deepen the market, could be a dangerous investment instrument as common investors could develop speculative interest with them.

For some analysts the global financial crisis that began in 2008 was a result of derivatives, which contrasts with the widely-held view that sub-prime mortgage lending and mortgage-backed securities such as collateralised debt obligations were the chief culprits of the biggest economic meltdown in recent times.

As such, the GSE has been urged to roll-out its sensitisation programme to educate the public and investment community on how the derivative market works, the kind of contracts that will be available, and the risks and benefits involved.

Click to view details

Business News of Wednesday, 18 May 2016

Source: B&FT