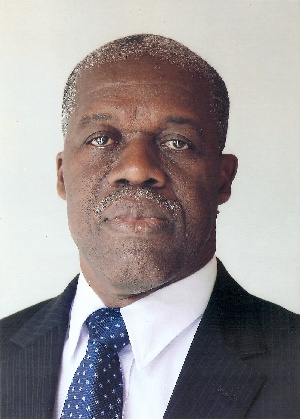

Bank of Ghana Governor Kwesi Amissah-Arthur has criticised naysayers who constantly predict the fall of the cedi, saying their actions exacerbate the currency’s depreciation.

He said apart from structural and demand factors, the actions of speculators and foreign-exchange traders who have been trying to profit from the cedi’s depreciation are fuelling the fall.

The cedi has depreciated by more than 8% in the first four months of the year, losing nearly as much value as it gave away in 2011 and causing the Central Bank to hike its policy lending rate in February, the first increase in three years.

On Friday, the bank’s monetary-policy committee (MPC) raised the rate by a further 100 basis points to 14.5% -- the highest level since April 2010.

“I don’t understand why people are talking down the cedi. This does not help. The Central Bank is responsible for 90% of foreign exchange transactions, and some of these traders who quote high [exchange] rates operate in a minor segment of the market,” Mr. Amissah-Arthur said.

On Friday, the bank quoted the average exchange rate at one dollar to 1.69 cedis, while some currency traders quoted it at one dollar to 1.79 cedis. The bank’s data also showed forex bureaux were buying the dollar at 1.77 cedis.

Rising foreign-exchange demand to sate the country’s appetite for imports has been putting pressure on the currency, while weaknesses in advanced economies; particularly the crisis in the euro zone, have reduced capital flows into the economy.

“If you are having growth rates of 14-16%, then adjusting to your new import requirements takes some time, so we consider this to be a temporary development,” Mr. Amissah-Arthur said.

He said another cause of the cedi’s volatile movement is the cash-based nature of transactions between Ghana and its Asian trade partners, especially China, which has become the main source of the country’s imports. The absence of corresponding banking relationships between local banks and their Asian counterparts has increased the reliance on cash, and therefore put pressure on the cedi, he added.

Last year, the economy spent US$15.9billion on imports; an almost two-fold increase in just two years, contributing to a widening of the trade deficit by 8% to US$3.2billion. A 60.6% increase in exports to US$12.7billion on the back of new oil production was still not enough to cut the deficit.

The MPC, according to the Governor, raised the policy rate to stem the cedi’s depreciation in order to build reserves to levels that will be able to withstand external shocks. He said it also intends to minimise the risks to inflation and growth.

“Although growth potentials remain strong, prevailing exchange rate developments could act to offset the gains made in macroeconomic stability. Given the current macroeconomic conditions, the assessment of the MPC over the forecast horizon shows an elevated inflation profile.”

March consumer inflation rose to 8.8% from 8.6% in February, the highest since May 2011, driven by increases in both food and non-food inflation. Real GDP growth for 2011 was however revised to 14.4% from an earlier estimate of 13.6%.

Governor Amissah-Arthur said, the Central Bank, in a bid to improve foreign-exchange supply by banks to the market, will lower the required single currency net open position (NOP) of banks; the difference between their assets and liabilities in a single currency, to 10% from 15% and reduce the aggregate NOP to 20% from 30%.

The bank is closely monitoring developments, and will not hesitate to take additional measures if deemed necessary, he said.**

Business News of Monday, 16 April 2012

Source: B&FT