In seeking good returns on shareholder’s investment, the Board of Directors of Suma Rural Bank limited at Suma-Ahenkro in the Jaman North District of the Brong Ahafo Region have proposed a dividend of GH¢134,968 -- which is 50% of profit after tax for the 2014 year under review; it is 0.38 pesewas per share to be paid.

The Board has further proposed that the dividend so declared should be used as bonus shares for all shareholders to beef-up the bank’s share capital of GH¢396,134 in order to cushion its drive to meet the new RCBs’ minimum capital requirement of GH¢1,000,000 by 2017.

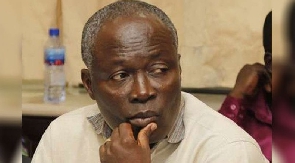

Mr. Johnson Ofori Asubonteng, Chairman of the Board of Directors, made this known at the 29th Annual General Meeting of shareholders held at Suma-Ahenkro. He appealed to shareholders and potential investors to side with the directors in their quest to increase share capital, adding: “Our inability to meet the new minimum capital requirement may force the bank to merge with another sister bank or fold-up”.

He said the turbulent economic situation during the year under review had a massive toll on the bank’s financial performance indicators. The GDP growth target of 8% set by the state could not be realised as 4% was achieved during the period. The cedi helplessly lost value to major trading currencies while interest rates on government Treasury-bills rose to 25% per annum, which attracted depositors, he stated.

Another issue of concern to the bank, the Board Chairman pointed out, is “exorbitant communication cost” in the computerisation of its operations. He said due to the associated high cost, the bank might consider opting out of the T-24 banking application system, the software that is being used by the RCBs under supervision of ARB Apex Bank.

These and many factors affected the bank’s desired growth. Its total deposits increased marginally from GH¢5,963,903 at the end 2013 to GH¢6,525,229 in 2014, indicating a rise of about 9%. Loans and advances went up by 7.2% from GH¢3,325,670 to GH¢3,564,524.

The bank’s total assets at the end of 2014 were put at GH¢8,402,876 as against GH¢8,377,244 in the previous year. The capital adequacy ratio, which basically shows the bank’s solvency, was pegged at 20.71% as compared to the minimum requirement of 10%.

Mr. Asubonteng noted that notwithstanding challenges, the bank managed to record a profit before tax of GH¢300,712 during the year. This figure, according to him, exceeds 2013’s profit by GH¢37,998.

He announced that the bank has started development projects as Kokoa in the Jaman North district and Camp Junction in the Western Region, aimed at opening new agencies of the bank in those communities. Mr. Asubonteng therefore thanked the directors, management and the staff of the bank for their cooperation and contributions toward the bank’s growth, and urged them to keep it up.

Click to view details

Business News of Thursday, 26 November 2015

Source: B&FT