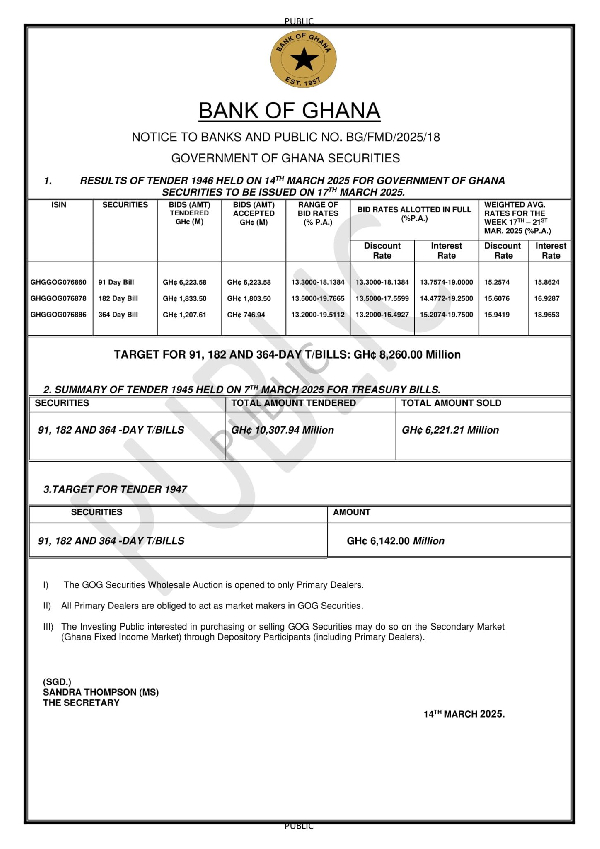

Investor demand for Ghana’s short-term government securities remained resilient in the latest Treasury bill auction on March 14, 2025, with bids totaling GH¢9.26 billion, exceeding the government’s GH¢8.26 billion target by 10.7%.

Despite the oversubscription, yields continued to decline across all maturities.

The government accepted GH¢8.77 billion in bids, surpassing its target by GH¢512 million while rejecting GH¢490 million worth of offers.

The 91-day bill saw the strongest demand, attracting bids of GH¢6.22 billion, all of which were accepted.

The 182-day and 364-day bills recorded bids of GH¢1.83 billion and GH¢1.20 billion, with accepted amounts of GH¢1.80 billion and GH¢746 million, respectively.

Yields on the 91-day and 182-day instruments fell to 15.86% and 16.92%, down 185 and 204 basis points from the previous auction.

The 364-day bill also declined, settling at 18.96%, a 102-basis-point drop.

The auction results come as the government plans to raise an additional GH¢6.14 billion in short-term debt at its next sale on March 21, 2025.

SP/MA

Business News of Monday, 17 March 2025

Source: www.ghanaweb.com

![Declan Rice shouting at Partey [L] Declan Rice shouting at Partey [L]](https://cdn.ghanaweb.com/imagelib/pics/372/37287055.295.jpg)