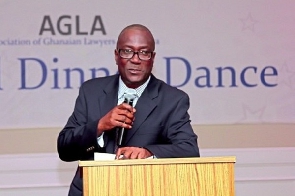

Just as businesses are saddled with taxes to allow government to rake in some revenue for the country, the Executive Director of the Centre for Democratic Development (CDD-Ghana), Professor Henry Kwasi Prempeh, has opined that it is about time churches were roped into the tax net as well.

In his view, the business of winning souls is gradually becoming lucrative and tax exemptions these churches enjoy must be revoked.

Professor Prempeh stressed that only churches that can prove that monies received were invested in charitable work or used to support missions should be freed from any tax exemption policy.

In a Facebook post sighted by GhanaWeb, he said, “You only have to listen to some of the things these sole proprietor preachers propagate and peddle on the airwaves to know that we are long overdue for a reset in State-Church relations. The current situation where there is zero entry barrier to the establishment or operation of a “church” is certainly not sustainable.”

“Let’s begin by doing away with blanket tax-exemption for churches and, instead, subject churches to income tax (a tax on their net income), granting each church tax credits or exemptions only upon auditable proof that incomes have been used to support missionary or charitable work,” the CDD boss stated.

“The same consumer protection philosophy that underpins laws and regulations in areas like food and drug safety, securities, etc., could be applied to the regulation of the business of winning souls," part of his post read.

Meanwhile, in Ghana, President Nana Addo Dankwa Akufo-Addo has assented three new revenue bills; Income Tax Amendment Bill, Excise Duty Amendment Bill, and Growth and Sustainability Amendment Bill into law.

The Growth and Sustainability Levy is expected to raise approximately GH¢2.216 billion in 2023, while the Income Tax (Amendment) Bill, 2022 which amends the Income Tax Act, 2015 (Act 896) is expected to yield revenues of approximately GH¢1.29 billion.

The Excise Duty (Amendment) Bill, 2022 amends the Excise Duty Act, 2014 (Act 878) and is expected to yield approximately GH¢455 million.

ESA/FNOQ

Business News of Thursday, 27 April 2023

Source: www.ghanaweb.com