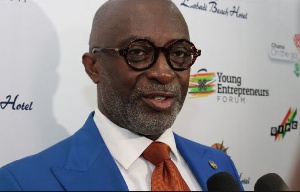

While the Ghana Revenue Authority (GRA) has been tasked to meet ambitious revenue targets as part of its domestic revenue mobilisation efforts, it is ironic to hear the Chief Executive Officer-Ghana Investment Promotion Authority (GIPC), Yofi Grant, complain about the negative impact of tax harassment on foreign investors.

The GIPC CEO raised concerns about harassment of foreign-owned businesses by tax officers from Ghana Revenue Authority (GRA). He said, on a daily basis, at least three to five foreign-owned businesses visit the GIPC office to complain about constant harassment due to varying tax charges and policies.

Mr. Grant warned that the constant harassment – combined with investor concerns such as unfavourable tax policies, exchange rate fluctuations and inflation – has become a major impediment to existing businesses in the country.

“It has great potential to undermine the economy’s attractiveness as an investment destination.”

The GIPC CEO notes that foreign direct investments to Africa have reduced significantly post COVID-19. Therefore, he is calling for a collaborative approach to resolving tax-related issues.

The domestic economic landscape has been significantly impacted by tax policies implemented since 2017. Investors and businesses are grappling with high interest rates on loans from financial institutions, local currency volatility and high inflation – along with other nuisance taxes that hinder business growth and sustainability.

High taxes lead to decreased consumer spending and business investment, which in turn can result in lower overall economic activity.

The impact of tax harassment and other tax policy implications has seen a recent trend of multinational brands like Glovo, Nivea, Game, Jumia Food and Unilever exiting the market – attributed to the country’s unfavourable economic climate.

Hence, the GRA has been urged to find innovative ways of collecting outstanding taxes from businesses without regularly showing up at their doorsteps.

The inflow of FDI is often induced by fiscal incentives such as tax exemptions, holidays, rebates and waivers of import duties on machinery and other inputs. Obviously, these deprive host nations such as Ghana of needed revenue for expenditure on social services such as health and education.

Ghana is one of the sub-Saharan African nations to execute economy-friendly policies that create a favourable atmosphere for enticing FDI. As the debate rages, it is important to recognise that the share of government revenue in GDP remains low compared with the average obtained in developing countries.

Business News of Wednesday, 4 September 2024

Source: thebftonline.com