In what could be a game-changer, telecom network operators in the country have offered to assist financial institutions to identify, manage and mitigate credit risk using borrowers’ consumption pattern of telecom services.

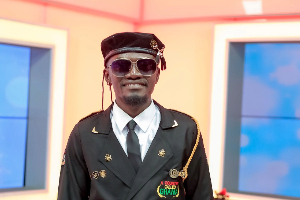

The Chief Executive Officer of MTN Ghana, Ebenezer Twum Asante explained that telcos can help especially the banks to determine the credit worthiness of borrowers using data from customers’airtime purchase patterns over a period.

Mr. Asante explained that subscribers’ airtime consumption and borrowing pattern as well the time it takes for a customer to payback airtime borrowed could help cushion banks against the increasing non-performing loans in the banking system.

“If you have the right database, why would someone have to queue to be served? We have the data, we have records of the customer spending pattern which could be used by banks. For example, we sell airtime on credit and we can tell which customer is creditworthy based on their purchase pattern over a period of time.

“So I see telcos and banks getting closer and in my estimation, there will be formal and informal convergence of telcos and banks,” he said at an interaction with the Chartered Institute of Marketing Ghana (CIMG) in Accra.

Mr. Asante’s comments come amid the tightening credit conditions in the banking system on the back of high non-performing loans, which reached a ten-year high of 19.1 percent at the end of August this year.

The credit environment has been poisoned by the difficult business operating environment, which has made banks vulnerable to the risks of default.

However, the proposal of the mobile network companies presents a key challenge to the data protection law enacted to protect the privacy and disclosure of personal data.

Nonetheless, the proposition offers the chance for banks to deepen their relationship with the telecom firms to sanitize the banking space despite fears that the two sectors are in competition for customers’ deposits.

Mr. Asante believes that by working together with banks, telcos could help the banking industry to curb the rising non-performing loans.

The evolution in the financial services sector he said is “inevitable,” and that the customer is the principal determinant in this dialogue.

“What I am talking about is the convergence between the pure financial sector and pure telcos. “Telcos are taking advantage of the banking sector and the financial sector is also taking advantage of telcos.

“I think that going into the future, we will continue to see more and more of such collaborations and convergence,” Mr. Asante added.

A financial analyst and Chief Executive Officer of Africa Investment Group, Dr. Sam Ankrah who has researched on the impact of mobile money on the country’s financial sector, corroborated that telcos can be a solid cash flow generator and that banks should be working with them to better serve their clients.

“I absolutely agree. Fintech is the future and we are seeing that loan repayments through technology and empirical data have a lower default rate.

“Banks are limited to denser cities but with telcos, they can service customers in the most isolated regions as long as they get connectivity. The benefits are stupendous where fewer places are far for the banks to cater and for them to expand their customer base.”

Business News of Saturday, 22 October 2016

Source: B&FT