A former GNPC boss dissected what it means for investors if the government decided to restructure its debts.

He explained: “That means that investors will get some pesewas to each cedi (for GoG Treasury investors) or cents to each dollar (for Eurobond investors) of the principal invested”.

In other words, he said: “They will receive only a fraction of their investments.”

Mr. Mould noted: “Any attempt by the government to give investors a haircut on their investment principal will result in the government not being able to go to the capital markets for many many years to come.”

Read the full story originally published on August 29, 2022, by classfmonline

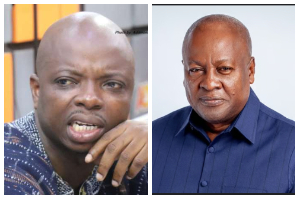

A former Chief Executive Officer (CEO) of the Ghana National Petroleum Corporation (GNPC), Mr. Alex Mould, has said any attempt by the government to give investors a “haircut on their investments” will be resisted.

Mr. Mould said slashing the principal of investors would lead to lawsuits that can drag the country’s current credit crunch.

In a write-up titled, ‘Investors get jittery over investments in government treasuries and GoG Eurobonds – Part 1’, Mr. Mould said: “There are many rumours going around the financial markets that the government of Ghana is contemplating giving all investors in Treasuries and Eurobonds a haircut”.

He explained: “That means that investors will get some pesewas to each cedi (for GoG Treasury investors) or cents to each dollar (for Eurobond investors) of the principal invested”.

In other words, he said: “They will receive only a fraction of their investments.”

Mr. Mould noted: “Any attempt by the government to give investors a haircut on their investment principal will result in the government not being able to go to the capital markets for many many years to come.”

He indicated: “This also could be resisted by many investors and there could be lawsuits by investor blocks which could drag Ghana’s current credit crunch; this option is like a road to perdition and only reserved for the non-salvageable economies in the world.”

Business News of Wednesday, 7 December 2022

Source: www.ghanaweb.com