Traders and local manufacturers have called on the government to put in place measures to stabilise the Cedi from depreciating against the dollar and other major trading currencies.

They also called for the removal of the five per cent excise tax on locally manufactured products to ease the cost of doing business and support Ghana’s economic recovery.

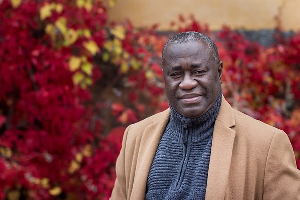

Speaking at the Mid-Year Budget Review forum organised by the Finance Ministry to solicit input, Dr Joseph Obeng, President, Ghana Union of Traders’ Association (GUTA), said, though Ghana had made trade surplus which should help strengthen the Cedi, the currency continued to depreciate.

He said reality on the grounds had been that proceeds from the export Ghana embarked on did not return into the country, adding that the country needed to have a policy or regulation where some of these funds could return to Ghana before disbursement.

Ebo Botchwey, President, Ghana Plastics Manufacturers Association (GPMA), said they would not expect any new taxes for the remaining of the year but urged the government to “do away with the five per cent obnoxious excise tax which had been crippling their businesses.”

Emmanuel A. Cherry, Chief Executive Officer, Ghana Chamber of Construction Industry, also urged the government to issue prompt payments whenever they raised a certificate of payment within a stipulated time in contracts.

"The government always defaults. And in the default, it uses the simple interest calculation but in the financial market they use compound interest anytime we borrow and default. The government needs to be fair to us,” he said.

Dr Stephen Amoah, Deputy Minister for Finance, lauded the inputs made and said they were operating an ‘open culture system’ where institutions and other stakeholder groups were allowed to be part of the decisions on how the taxes collected were going to be utilised.

He said though governments around the world would love to prosecute some projects to win vote in an election year and spend a lot of money, the government had been committed to preventing reckless spending particularly this year.

“One of the decisions taken is that we are not going to ask for additional funds. There are not going to be additional tax because we are listening to stakeholders. We want to strengthen our economy, reduce volatilities and dysfunctional issues bedeviling it,” Dr Amoah said.

The Mid-Year Budget Review would focus on housing and roads financing and therefore would encourage private sector investment through public-private partnership (PPP).

The Forum was attend by members from the business and construction communities, Civil Society Organisations (CSOs), academia and Economists.

Watch the latest edition of BizTech:

Business News of Sunday, 14 July 2024

Source: GNA