Tullow Ghana has brought together seven banks and over 250 indigenous suppliers in the oil and gas Industry to facilitate and institute easy access to credit financing and other financial sources in order for them to take advantage of business opportunities created by local content legislation in the industry.

The financing process is in response to various feedbacks the company has received from the local companies who are constrained by the challenges of getting access to credit as well as the cost of capital for undertaking projects in the sector.

This has created the need to assemble a consortium of banks and the companies themselves to discuss the various financing packages the banks are willing to offer the suppliers.

According to Tullow Ghana, it has received many requests from a number of financial institutions willing to offer a variety of financing packages and solutions to local suppliers in the upstream oil and gas industry.

The initiative forms part of Tullow’s shared prosperity philosophy which is based on the principle that a country’s hydrocarbons must be a catalyst for its economic growth and one of the measures to achieve this is to offer opportunities along the supply chain to indigenous enterprises and facilitate easy access to financing for such local players in the oil and gas industry.

This is seen as encouraging to a number of local industry suppliers in the sense that in a capital-intensive industry such as oil and gas, if companies do not have access to credit financing, it becomes difficult for them to participate in the supply chain of the sector.

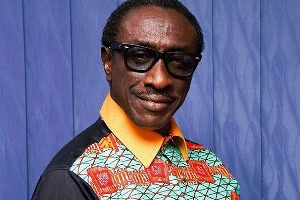

Director of External Affairs, Social Performance and Local Content of Tullow Ghana, Madam Cynthia Lumor told the Goldstreet Business last week that the initiative forms part of the initial stage of the credit financing process and thus indigenous companies in the sector should look forward to more banks participating in the next engagement.

“Supply capacity building is a big part of local content. When the businesses of suppliers grow, jobs are created which result in more revenue for Government in terms of taxes”, she noted.

The banks that are participating in the initiative are Fidelity Bank, GCB Bank, CAL Bank, Standard Chartered Bank, Barclays Bank, Stanbic Bank and SG Bank.

To qualify to have access to financing, companies must have good balance sheets.

Business News of Tuesday, 11 June 2019

Source: goldstreetbusiness.com