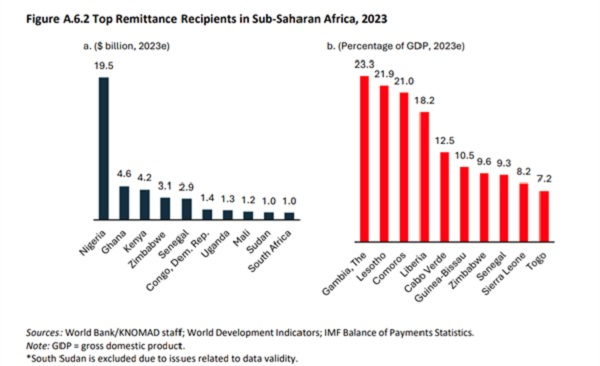

In 2023, Sub-Saharan Africa saw remittance flows reach US$54 billion, with Ghana among the largest beneficiaries, receiving the second highest inflows within the region, the latest World Bank Migration and Development Brief has shown.

During the period under consideration, remittances to the country reached US$4.6 billion, surpassed only neighbouring Nigeria’s US$19.5 billion.

The figure is marginally lower than the US$4.7 billion recorded in 2022. In 2021, the value of remittance into the country stood at US$4.5 billion.

Despite a slight regional decrease of 0.3 percent from the previous year, these funds have played a crucial role in stabilizing the nation’s financial health.

The country recorded a current account surplus in the third quarter of 2023, driven in part by robust remittance growth.

These inflows have been instrumental in mitigating the effects of food insecurity, drought, supply chain disruptions, floods, and debt-servicing difficulties. Such economic challenges have been exacerbated by global geopolitical tensions, including the Russian invasion of Ukraine and the Israel-Gaza conflict.

Unlike the volatile foreign direct investment (FDI) flows, remittances have proven to be a more reliable source of foreign exchange for Sub-Saharan Africa. In 2023, remittances to the region were nearly 1.5 times the size of FDI flows, which stood at US$38.6 billion. The largest recipients included Nigeria, Ghana, Kenya, and Zimbabwe.

Ghana’s dependence on remittances has become increasingly evident. These inflows not only support the current account but also provide a buffer against various economic shocks. For many Ghanaians, remittances from family members abroad represent a critical source of income.

“Remittance flows to the region supported the current accounts of several African countries that were dealing with food insecurity, drought, supply chain disruptions, floods, and debt-servicing difficulties,” the report emphasized, highlighting the stabilizing effect of these funds.

Recent efforts by the Central Bank of Nigeria (CBN) to unify the foreign exchange market and introduce new operational modalities for financial institutions have implications for Ghana. These regulatory changes aim to increase competition and reduce transaction costs, potentially benefiting Ghanaians receiving remittances from Nigeria.

However, the high cost of remittances remains a concern. In Sub-Saharan Africa, senders paid an average of 7.9 percent to send US$200 in 2023Q4, up from 7.4 percent in 2022Q4. Costs varied significantly, with some corridors charging as much as 36 percent. This underscores the need for more affordable and efficient remittance channels.

Regional Dynamics and Future Outlook

Kenya, one of the major remittance recipients, has shown promising signs with a 21 percent increase in remittance growth in the first four months of 2024 compared to the same period in 2023. This growth is largely driven by inflows from the United States, Canada, the United Kingdom, Switzerland, and Italy, signaling strong ties between the diaspora and their home countries.

Looking ahead, remittance growth to Sub-Saharan Africa is projected to recover slightly, from a negative growth of -0.3 percent in 2023 to an anticipated 1.5 percent increase in 2024. However, several risks loom on the horizon, including potential economic slowdowns in developed countries, escalating conflicts, and climate risks.

Migration Trends and Their Impact

Conflicts within Sub-Saharan Africa, particularly in Sudan, have led to significant cross-border population movements. The region is now hosting millions of internally displaced persons and refugees, with substantial numbers moving to neighboring countries. This migration trend underscores the interconnectedness of African economies and the importance of stable remittance flows.

Business News of Friday, 28 June 2024

Source: thebftonline.com