The central bank has said its decision to revoke the licences of UT and Capital Bank did not happen out of nothing as it intervened on a number of occasions to save the situation, without success.

Speaking to the press on Monday, the Bank of Ghana’s head of supervision, Raymond Amanfu, said: “These two banks have been assisted several times. Don’t forget that the central bank is the lender of last resort – as and when they need liquidity, we assist. But you cannot be under liquidity support forever. Therefore, it comes to a point where you have to take a decision and deal with the matter.”

But he said: “The matter is not too much about liquidity but about solvency and capital. Where your capital has been eroded by losses and bad loans, you have to recapitalise. These banks have brought several plans and we have sat with them; none of the plans could materialise.

We have had several discussions since this process started in 2015. So it’s not that the central bank is insensitive but just that at a certain point when action has to be taken, it must be taken swiftly just to protect depositors’ funds,” Mr Amanfu told the press.

Never again

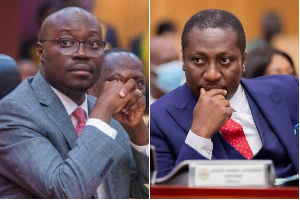

Also speaking at the event, the Governor, Ernest Addison, said: “The last phase of BoG’s action would involve a thorough investigation of operations of UT Bank and Capital Bank, and appropriate action will be taken against shareholders, directors, and key management personnel who are found to be culpable.”

He maintained that the action taken by the central bank, a Purchasing and Assumption transaction, was taken to protect depositors’ funds and strengthen the financial sector.

Justifying the action, Dr Addison said, the Banks and SDI Act, 2016, provides that undercapitalised banks be given 180 days to correct their capital position.

“Significantly, undercapitalised banks are requested to reach a minimum capital adequacy of 5 percent in 90 days and 10 percent in 180 days. In the case of insolvent banks and banks that are likely to become insolvent, the Bank of Ghana is mandated to revoke their licences,” he stated.

The two banks, he stated, were heavily deficient in capital and liquidity and that their continuous operation could have jeopardised not only their depositors’ funds but also the stability of the financial system.

A statement from the central bank, earlier yesterday, said all customers of the two banks automatically become customers of GCB Bank, which takes them over, and as such can access banking services at the various UT and Capital banks branches, which would now be in GCB’s name.

Business News of Wednesday, 16 August 2017

Source: thebftonline.com