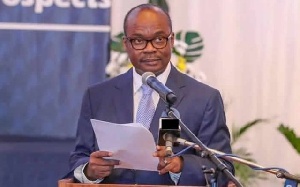

The Central has described the consolidation process in the banking sector as an expensive exercise.

The exercise he lamented cost the nation an amount of $12 billion but the exercise Dr Ernest Addison said has since ended and a strong and resilient banking sector should be expected.

Governor of the Bank of Ghana (BoG) Dr. Ernest Addison said Ghana currently have 23 universal banks as compared to the previous 33 we had in the past.

He explained that "the Minimum Capital Directive was part of regulatory measures aimed at strengthening and making the banking sector more resilient to shocks as well as to help reposition the banks to better support the growing needs of the Ghanaian economy. It was also the expectation of the Bank of Ghana that the recapitalisation exercise would help promote consolidation in the banking industry through sustainable mergers and acquisitions along with stronger corporate governance structures and risk management systems and practices.’’

Following the recapitalisation exercise that ended at the close of business on 31st December 2018, there are now twenty three (23) universal banks operating in Ghana. These banks have all met the new minimum paid-up capital of GHC400 million,’’ he disclosed.

A schedule of banks and how they have met the new requirement is attached as Annexure

1. In particular: Sixteen (16) banks have met the new minimum paid-up capital requirement of GH¢400 million mainly through capitalisation of income surplus and a fresh capital injection.

- The Bank of Ghana has approved three (3) applications for mergers. Consequently, First Atlantic Merchant Bank Limited and Energy Commercial Bank have merged, Omni Bank and Bank Sahel Sahara have merged, and First National Bank and GHL Bank have merged. The three (3) resulting banks out of these mergers have all met the new minimum capital requirement.

- Some private pension funds in Ghana have injected fresh equity capital in five (5) indigenous banks through a special purpose holding company named Ghana Amalgamated Trust Limited (GAT).

In addition to the state-owned banks (ADB, NIB) benefiting from the GAT scheme, the other beneficiary banks (the merged Omni/Bank Sahel Sahara, Universal Merchant Bank, and Prudential Bank) were selected by GAT on the basis of their solvent status and good corporate governance. More details about the GAT scheme will be provided by GAT and the Ministry of Finance.

To ensure that the capital provided by banks indeed represents quality capital in the amounts required to meet the Minimum Capital Directive, the Bank of Ghana adopted and implemented a rigorous capital verification process. In the process, the Bank of Ghana has undertaken 3 comprehensive due diligence on new investors in banks and has verified the sources of funds for the recapitalisation. The verification process is still on-going and will be validated by external auditors of banks as part of the 2018 external audit.

Business News of Saturday, 5 January 2019

Source: rainbowradioonline.com