Government has granted a concession to utility providers in the country to issue bonds on the capital market to finance expansion of their existing infrastructure as power supply has become persistently challenging.

Utility providers -- mainly the Volta River Authority, Ghana Grid Company Limited (GRIDCo), and the Electricity Company of Ghana Limited (ECG) -- in the country will be expected to streamline their finances and adopt the appropriate international financial reporting standards as a prelude to the issuance of bonds on the capital markets to finance energy infrastructure.

Mrs. Mona Quartey, Deputy Finance Minister, clarifying the issuance of energy bonds mentioned in the 2015 budget said: “We expect that they will adhere to the stock exchange regulations before you can go and issue bonds. For those institutions that would like to issue bonds, they will prepare themselves to be able to issue them and make themselves attractive. Government cannot issue a Government of Ghana bond with an institution hiding behind it. If ECG has to issue a bond, it will be an ECG bond”.

Seth Terkper, the Finance Minister in the 2015 Budget statement presented to Parliament on Wednesday, said: "We will continue to enhance the use of oil and gas resources to leverage the Capital Markets for development of the energy sector. This last initiative will involve the issuing of energy bonds through plans that draw on synergies among the Balance Sheets of capable state-owned enterprises (SOEs) and the private sector."

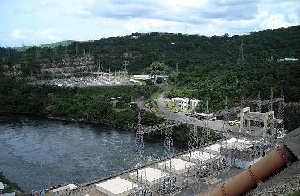

Rising electricity demand requires a sustained annual spending of some US$200million, on the generation side, to meet the demand over the next 10 years. The power transmitter GRIDCo also requires huge financing to bring its transmission lines up to speed with the kind of generation expected.

There have been several issues raised regarding the adequacy of ECG’s current installed infrastructure to enable the electricity distributor supply power to consumers.

Demand for electricity in Ghana increased by an all-time high of 12.38 percent in 2013, growing from the 2012 peak of 1,728.9Megawatts (MW) to 1,942.9MW at the close of last year.

Over the last four years, however, the average year-to-year growth in demand for electricity has been about 10 percent.

The peak demand for 2011 was 1,664.3MW, a 10.52 percentage growth over the 2010 demand of 1,505.9MW.

The estimated demand is growing, and current projections indicate that the country’s requirements for electricity will hit 2,764.2MW in 2015.

For a country using under 2,000megawatts of electricity currently, Ghana ought to be bringing on-stream 200 megawatts of new capacity every year. This additional capacity requires US$200million of investment.

The Securities and Exchange Commission (SEC) has been at the forefront of the campaign to get the major utilities to issue bonds to finance their capital infrastructure.

The VRA last year adopted the International Financial Reporting Standard (IFRS) as part of measures to streamline its operations to eventually issue US$500million of corporate bonds on the international capital market and raise funds for infrastructure projects.

The electricity producer had hoped to raise the amount to finance four new projects that would generate about 700megawatts of electricity within three to four years. However, a change in hierarchy set the process few notches back.

The Securities and Exchange Commission (SEC) has resumed discussions with the VRA about using the capital market to raise funds for its on-going and future projects.

Click to view details

Business News of Monday, 24 November 2014

Source: BFT