....Delayed costing millions

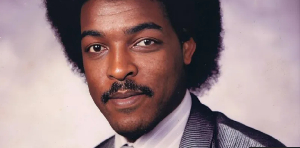

The delayed adjustment of power and water tariffs is causing the budget to haemorrhage resources and could prolong the time required to rebalance the government’s books, Minister of Finance Seth Terkper has told the B&FT.

Proposals for an increase in the tariffs, which have been frozen for almost two years, were submitted by the state-owned utility companies to the Public Utilities Regulatory Commission (PURC) in the first quarter of the year, but the regulator has yet to make a decision on the requests.

Meanwhile government, which has clearly indicated a policy of subsidies-removal, continues to incur obligations to the utility companies for the delayed tariff hikes.

“We know that there’s a process, and the PURC is going through the process. [But] the delay is causing a problem because since the prices have not been adjusted, every month we have to pay the differential,” said Mr. Terkper. “It only means that the rebalancing of the budget is taking longer.”

The Minister did not reveal the actual cost to the budget, but the B&FT has learnt from the Volta River Authority (VRA) that government’s net debt to the power producer was GH¢20million in the last quarter of 2012 and GH¢57million in the first quarter of 2013.

Government has also been raising letters of credit for the purchase of crude oil by the VRA, said its Chief Executive, Kweku Andoh Awotwi. A “clearing house” mechanism has been created, whereby government and the power companies reconcile their obligations to each other, he added.

The Electricity Company of Ghana also acknowledged that government owes it some unpaid subsidies due to the freeze on tariffs, but said it is awaiting a determination of the actual amount from the clearing house.

During his presentation of the 2013 budget to Parliament in March, Mr. Terkper cited hefty subsidies on petroleum products and utilities as one of the main causes of the blown-out deficit of 11.8 percent of GDP in 2012 -- almost thrice the gap in the previous year.

In 2012, an amount of GH¢809million was spent on utility and fuel subsidies - and payment of an additional GH¢955.8million was deferred to 2013. The combined obligation was GH¢1.76billion, or 2.4 percent of GDP.

While petroleum subsidies have since been axed, outstanding subsidies on electricity and water -- together with the relentless increase in wage expenditure -- remain a threat for plans to cut the deficit to 9 percent of GDP this year, Mr. Terkper said.

“The public should know that the freeze on the price is at the cost of school-feeding and other programmes.”

The International Monetary Fund (IMF) has cast doubts about the reduction in deficit to 9 percent of GDP, instead forecasting a gap of 10 percent of GDP. International investors also expressed tacit concern about Ghana’s fiscal situation when they demanded a yield of 8 percent per annum on the country’s Eurobond sold in July.

The Bank of Ghana has raised its benchmark policy rate by 100 basis points this year to 16 percent, as it seeks to limit the impact on inflation from the ongoing fiscal rebalancing. At its last policy meeting in July, the bank said it expects inflation -- which rose to 11.8 percent in July -- to end the year close to the upper band of its 9-11 percent target.

Business News of Wednesday, 28 August 2013

Source: B&FT

Utility tariff hikes

Entertainment