The new Value Added Tax (VAT) Act that requires banks to charge customers for non-core financial services are not new to the country, a government official has stated.

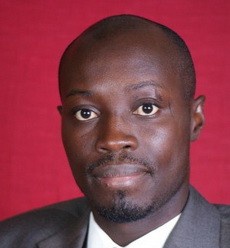

“It has been in place since 1998,” stated Cassiel Ato Forson, a Deputy Minister of Finance. The Member of Parliament for Ajumako-Enyan-Essiam Constituency noted that banks have been charging VAT on data processing, legal, accounting, actuarial, notary and consulting services over a decade now.

He, therefore, explained that the new law, Act 870, is only entreating banks to register for VAT so that they can offset it with the already charged fees. “Therefore, the impact of the VAT is not the full 17.5 per cent as being speculated.”

Mr Forson pointed out that government had wanted banks to start the policy implementation at the beginning of this year but had to give them some time to “fully” prepare.

It is expected to take effect from next week.

Click to view details

Business News of Wednesday, 23 April 2014

Source: tv3network.com

VAT on banking services not new – Ato Forson