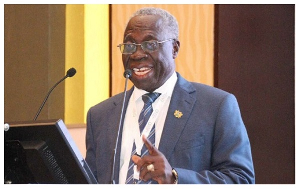

The Chief Executive Officer of the Ghana Chamber of Mines, Sulemanu Koney, has called on government to make VAT and other taxes payable only when commercially viable finds have been made.

The CEO explained to the Africa Report that exploration is high risk hence the need for Ghana to put in place better incentives for exploration.

“We are not happy with the level of investment we see in exploration,” Koney said.

Better incentives for exploration are “a major issue. That is where we need to focus,” he added.

According to Koney, it is worrisome that taxation is front-loaded before commercial finds are made. Therefore he is questioning the VAT’s liability of inputs used in exploration, which he sees as “not appropriate.”

The Ghana Chamber of Mines cries the country is losing potential mining investors to other destinations, particularly Burkina Faso, where exploration does not attract VAT.

Exploration for minerals in Ghana remains hampered by tax burdens and policymakers have been “sympathetic” to lobbying, but nothing concrete has happened yet, the CEO stated.

Koney finds it worrying that the Ghanaian industry is no longer dominated by mining majors.

“The industry has changed over the years” and about 40% of the country’s output now comes from small-scale producers. A greater focus on minerals other than gold can help attract greater foreign investment in mining.”

The challenge is to bring informal activity into formal sector to ensure responsible mining and payment of taxes, he argues.

Ghana is likely to extend its lead in gold production over South Africa this year, having become Africa’s largest gold-producing country for the first time in 2019, Koney said.

Business News of Monday, 27 January 2020

Source: www.ghanaweb.com