The Volta River Authority (VRA) has set in motion a restructuring process, which will see it cede its non-core businesses to private investors, two years after the idea was initially advanced.

Delineation of the non-core businesses is meant to ensure a more transparent budgeting for tariff requests by the authority to the PURC, so that nominal costs are not passed on to consumers. The state-owned power generating company is currently responsible for the wages and salaries of the over-520 employees in its property department, as well as its hospitals and schools, which do not constitute its core business.

The B&FT understands that the delineation of its non-core businesses is expected to lead to a reduction in cost of production and ultimately end-user tariffs, as VRA would be more efficient.

The authority has interests in schools – Akosombo International Schools; hospitals- the VRA Hospitals; hospitality--Volta Hotel; lake transport-- Volta Lake Transport Company (VLTC); farms – Kpong Farms Limited; tourism and leisure—Dodi Princess and others.

On behalf of the Volta Lake Transport Company (VLTC), VRA published a request for expression of interest for partnerships to improve in the delivery of lake transport service in the Wednesday November 9, 2016 edition of the B&FT.

The VLTC, a wholly owned subsidiary of Volta River Authority (VRA), operates as a carrier of all forms of water-borne transport, including hovercraft for persons/or freight on the Volta Lake. The company currently operates a fleet of passenger vessels, cargo ships and barges.

“Interested and eligible investors are required to demonstrate ability/capacity to mobilize resources and provide industry expertise to the company,” the request for expression of interest said.

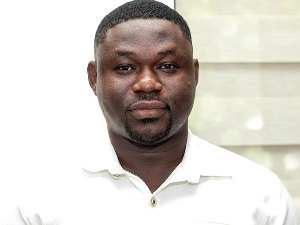

Kweku Andoh Awortwi, former CEO under whose watch the move was initiated, told the B&FT that: “VRA needs to focus on power generation, especially in times of financial difficulty. If it is facing difficulties, why burden itself with some of the non-core businesses?”

In June 2016, WAPCo and the gas supplier – NGas – curtailed supply to Ghana due to lingering debt, estimated to be about US$162million. The authority is also indebted to various local banks.

In an RFI published on October 19, 2016, the Authority also invited private participation in the management of Kpong Farms Limited, in a leasehold arrangement.

The Kpong Farms is located at Akuse in the Eastern Region. The land area is approximately 252.75 hectares, out of which 100 hectares are irrigated lands suitable for rice production.

Its properties include facilities designed for livestock and poultry production, a slaughterhouse and related facilities; rice fields and mill, storage houses, gantry workshops and a central office building.

“Based on an integrated farm approach, prospective investors would require an initial capital investment of between US$1-3 million (Ghana Cedis equivalent) to reactivate and operate the farms. VRA expects lease payments and expects that the farmlands will be used for the purpose for which it was acquired,” the authority said.

Mr. Awortwi believes that private participation in the running of VRA’s non-core assets is the way to go, although he cautions that “without incentives, it may not achieve its goals.”

Business News of Wednesday, 23 November 2016

Source: B&FT