The total value of secured loans granted and registered by banks and special deposit-taking institutions (SDIs) grew by 15.5 percent year-on-year – reaching GH¢5.9billion at end of second-quarter 2023 (2Q23), fresh data from the Bank of Ghana (BoG) have shown.

The latest figure represents a 12.7 percent improvement over the GH¢5.26billion recorded in first-quarter 2023.

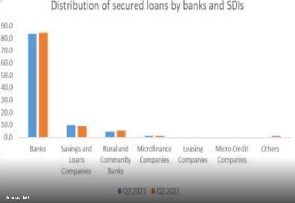

The data, contained in the second quarter of the 2023 Collateral Registry Report, showed the dominance of banks in this segment as they accounted for 83.7 percent – GH¢4.9billion – of all loans given out during the period. This was 14.8 percent more than the GH¢4.3billion given out in the same quarter of 2022.

Meanwhile, SDIs – comprising microfinance companies (MFCs), rural and community banks (RCBs), micro-credit companies (MCCs), financial non-governmental organisations (FNGOs), savings and loan companies (S&Ls) and finance houses (FHs) – granted loans to the tune of GH¢971.1million, which is 16.2 percent of the total loans.

However, there was a significant increase in the share of secured loans granted by S&Ls, which rose to 9.8 percent from 7.2 percent in the same period last year. S&Ls also dominated the 50,695 collateral registrations with 39,796 registrations. Banks registered 2,534 collateral registrations and RCBs registered 6,019.

“Of the lending institutions, savings and loans companies remained most active on the Registry platform, in terms of registrations, searches and discharges,” a portion of the report read.

The average lending rate for secured loans remained high, at 26.9 percent for banks and 44.2 percent for SDIs. However, there was some variation in lending rates across different sectors and borrower types. For example, the average lending rate for secured loans to large private enterprises was 29.3 percent while the average lending rate for secured loans to individual borrowers was 41.4 percent.

The distribution of secured loans by borrower type showed that large private enterprises accounted for the largest share, at 66.4 percent. Individual borrowers were the second-largest recipient, with a share of 15.7 percent.

The sectorial distribution of secured loans showed the commerce and finance sector received the largest share at 31.1 percent. The electricity, gas and water sectors followed with 28.8 percent, and the services sector with 15.2 percent.

Gender distribution

In the second quarter of 2023, secured loans to female borrowers and female-owned businesses amounted to GH¢781.4million, marking a substantial 64.5 percent increase from the GH¢475.1million recorded in the same period in 2022. In contrast, loans granted to male borrowers and male-owned businesses decreased by 35.3 percent – totalling GH¢2.2billion, down from GH¢3.4billion over the comparative period.

In terms of relative share, loans to male borrowers and male-owned businesses dropped from 66.3 percent to 37.3 percent, while loans to female borrowers and female-owned businesses increased from 9.2 percent to 13.1 percent during the period under review. Loans to other borrowers increased to 49.6 percent in the second quarter of 2023, up from 24.5 percent in second-quarter 2022.

Analysts have stated that the marginal growth in secured loans is a positive sign for the economy, as it suggests that businesses are confident about the future and are willing to invest. However, concerns over the high average lending rate is a concern, as it could make it difficult for small businesses and entrepreneurs to access credit.

Business News of Thursday, 7 September 2023

Source: thebftonline.com