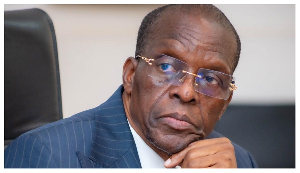

Governor of the central bank, Henry Kofi Wampah, has said that the bank has learnt its lessons and will “slow down” on licencing Micro Finance Companies in view of the rising cases of fraud.

The governor agrees that it is too large a number for the country to have some 500 microfinance companies, saying: “So we have taken a decision to slow down on the numbers”.

He assured parliamentarians who summoned him to respond to the upheavals in the sector that the central bank will work with an umbrella-body of the MFIs to tighten regulation of the sector.

“There is an association called the Ghana Association of Microfinance Institutions. We are working with them and I think we will strengthen them more. It is an umbrella-body that can work like the Apex bank, so we will continue to work with them and achieve that,” he said.

Finance Committee members of Parliament James Avedzie and Anthony Osei Akoto had enquired from the governor whether the central bank will partner the Apex bank to supervise the MFIs.

He equally admitted that the central bank’s decision to raise the minimum capital requirement for the sector has not fully succeeded in curbing the large numbers.

A directive by the BoG asked MFIs -- which presently require GH¢100,000 to operate -- to ramp-up their core capital to GH¢2million by 2018; while rural banks that now need GH¢150,000 to operate are to gradually meet a new capital requirement of GH¢1million by the end of December 2016.

“We try as much as possible to not have a non-tariff barrier. So the barrier would be the capital that is needed, which may reduce the numbers but appears not to be working well. So we have learnt from our lessons and we have slowed down on the numbers,” he assured the parliamentarians.

Asked about the possibility of reducing the numbers further, the governor said: “Many of them have started taking deposits already, so the problem will arise again if we don’t manage the situation properly. We can’t just go there and close them down. So we rather try to work with them to reduce the risks that are involved going forward”.

The central bank’s Head of Other Financial Services, Raymond Amanfu, explained to B&FT that the latest directive requiring microfinance firms to increase their stated minimum capital progressively over the next three years, and that of rural banks over the next two years, is to protect depositors.

It is also meant for the BoG to stay abreast with dynamics of the economy and also make sure these institutions have capacity to undertake the full extent of business they are engaged in, he noted.

“Looking at the dynamics -- which include the economy, the size of the microfinance institutions (MFIs) and the nature of the business they are doing, and the fact that their capital is continuously eroded by their activities and size of the loans they give -- these MFIs need to cushion themselves. That is why we extended the capital and deadline,” he said.

Wampah also proposed an increase in the amount to be paid to depositors who lose their investments to financial institutions under the Deposit Protection bill.

The figures, he said, must be reviewed upward; and hence he pleaded with MPs to expedite action on passage of the bill.

‘‘We have two bills with you. One is the Specialised Deposits bill and the other is the Deposits Protection bill. These two bills are with you and we believe you will look at them quickly. We are hoping they be looked at before the end of March,’’ Dr. Wampah added.

Business News of Friday, 11 March 2016

Source: B&FT