The ARB Apex Bank Limited a financial institution mandated by the Central Bank to offer tailor made support services to the rural banks has hinted that it will not condone any act of financial malfeasance that may be recorded in the rural banking industry.

Management of Apex Bank has asked all RCBs to submit fraud returns to both Bank of Ghana and the ARB Apex Bank Limited every month. Apex Bank is currently compiling a database of personnel who have involved themselves in fraud or any act of financial malpractice which will be duly publicised to all RCBs. The Apex Bank therefore believes that this will help them weed out the bad nuts from the rural banking industry.

The Apex Bank has also advised RCBs to seek reference from the Bank of Ghana as well as the ARB Apex Bank whenever they are appointing new staff. Additionally, boards of RCBs should ensure that operational control structures in their banks are effective. Moreover, prompt and stringent punitive actions should be instituted to deter staff from perpetrating fraud.

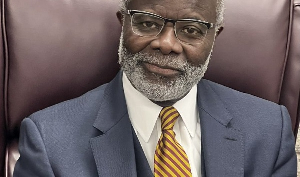

The Managing Director of ARB Apex Bank Limited, Kojo Mattah gave the hint in a speech read on his behalf by Mr George Annor, Kumasi Manager of Apex Bank at the 31st Annual General Meeting of shareholders of Odotobri Rural Bank at Jacobu recently.

According to him, fraud remains a key issue that negatively affects the operations of banks. They have identified many instances of the occurrence of fraud in the operations of RCBs which are attributed largely to the non-adherence to account opening procedures, non-adherence to customer identification requirements in the money transfer business, abuse of the credit management process, leakages in ‘susu’ deposit mobilisation and deposit suppression by tellers.

The rest are weaknesses in inter-bank and inter-agency reconciliation activities, fraudulent withdrawals from various accounts (e.g. suspense, dividend, and payment order), abuse of the imprest management system, withdrawals from dormant and deceased accounts as well as non-adherence to procurement procedures in the acquisition of fixed assets, especially IT equipment.

Mr Mattah, added that his outfit has noticed that credit management practices in many of the banks are largely weak which has resulted in a number of RCBs reporting high levels of non-performing loans.

According to him, statistics from the RCBs Performance Report at the end of March 2017 indicated that the rural banking industry recorded a Non- Performing Loan Ratio of 14.20% which was significantly higher than the benchmark of 5% with ninety-eight banks recording ratios above the benchmark.

The MD has entreated all boards and management of rural banks to put in place measures to strengthen credit management so that its attendant negative effect on liquidity of the banks would be averted. This he said would enable the banks improve upon their profitability performance.

Mr Mattah has also reiterated that corporate governance, risk management and compliance issues which are intertwined have taken centre stage in the effective management of banks in recent times and RCBs are no exception and should therefore be properly coordinated.

Governance describes the approach through which the board and management direct and control the affairs of the bank to attain its objectives.

Risk management is the processes through which management identifies, analyses, and responds appropriately to risks that might adversely affect the realisation of the bank’s objectives.

Compliance refers to adhering to stated requirements. These include the bank’s policies, procedures and contracts. RCBs should also comply with laws, regulations and directives from regulatory institutions which have impact on their operations.

Business News of Wednesday, 29 August 2018

Source: thebftonline.com