It is a week to the implementation of government’s controversial tax stamp policy but beverage manufacturers, importers and exporters still maintain paper stamps are not the way to go.

At a press conference organised by the Food and Beverage Association of Ghana (FABAG), with support from Ghana Union of Traders Associations (GUTA), the Ghana Institute of Freight Forwarders (GIFF), and Importers and Exporters Association of Ghana, the business leaders served notice to government to suspend or risk non-compliance on their part.

“We call on the Ministry of Finance (MoF) to, as a matter of urgency, suspend the implementation to re-engage stakeholders at the policy table so that we can adopt the best practicable and workable technology for the good of mother Ghana.

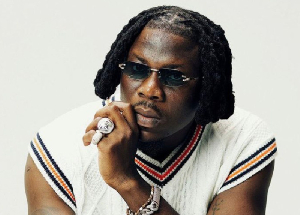

On the other hand, we call on the Ghana Revenue Authority (GRA) to stop the deceit being perpetuated out there and suspend the advert that is being run on some radio stations as if the stamps are free and seeking to create the impression that importers excisable goods are not paying duties,” Samuel Aggrey, General Secretary of FABAG said.

Mr. Aggrey added that the association will be calling on parliament to fully investigate the tax stamp policy because they believe investors and the tax payer are being short changed because “this is not value for money.”

Government has decided on March 1, to commence the enforcement of the tax stamp policy, where paper stamps are supposed to be affixed to every bottle of excisable beverages or water, as well tobacco and tobacco products.

But the manufacturers and importers argue that whilst they are not against the policy in principle, affixing paper stamps to bottles on high speed production lines would slow down the production process by at least 10percent and would lead to avoidable losses.

The companies are proposing that instead of the paper stamps, government should consider allowing them to digitally print tax codes onto the bottles, which would save production time and would be less costlier to both parties.

“It is evident that each stage of the tax stamp implementation process comes with huge cost to businesses. The undue high cost of compliance of the tax stamp policy is unacceptable, but seeing the belligerent posture adopted by the state, this leaves us with very little option,” Mr. Aggrey added.

Government’s insistence on rolling out the policy, for which a law was passed back in 2013, appears to lie in the fact that the paper stamps have already been procured, and the American company behind the supply of the stamps and the machines to be used for affixing them –Authentix Inc. – is eager to see results.

If the policy takes effect on March 1, it would mean that, aside cigarettes and other tobacco products, all alcoholic or non-alcoholic beverages and water, “whether bottled, canned, contained in kegs for sale or packaged in any other form,” would have to have the paper tax stamps affixed to them.

Controversy over how to affix stamps

Section 8 (2) of the Excise Tax Stamp Act 873 of 2013 states that the stamps “shall be affixed on a product unit in a manner that ensures that the stamp will be broken or will be rendered unusable when the product unit is opened.”

To do this, the Tax Stamp Implementation Committee has indicated that the stamp on the beverages be affixed to the top of the bottles or across the crown cork. The idea is to ensure that one stamp is not used more than once.

Industry people argue, however, that affixing the stamps in the manner the law prescribes is impracticable since the bottles may be wet at the time of labelling due to condensation, making it difficult for the stamps to stick on them.

Authentix Inc. has carried out trials, but there is a disagreement between the manufacturers on the one hand and the government and Authentix on the other, as to whether the trials worked. Whilst Authentix insisted that they worked, the companies argue that the trials were a complete failure.

Upon further consultations, the parties agreed to carry out further trials between January and February 2018. Here, again, there is a stalemate in that government has asked that any company interested in partaking of the trials should cough up US$10,000 to cover costs, since Authentix has said it would not absorb the cost the second time.

Background

The Government of Ghana, in December 2012, entered into an agreement with Authentix Inc. of the USA for the supply of tax stamps, tax stamp applicator and consultancy services for tracking of excisable goods sold in Ghana.

Following that, parliament, in 2013, ratified the agreement with Authentix and an Excise Tax Stamp Bill was introduced and passed as Excise Tax Stamp Act 2013 (Act 873). After receiving Presidential assent in January 2014, the law came into force.

Business News of Wednesday, 21 February 2018

Source: thebftonline.com