A million dollars doesn’t go very far in the most expensive real-estate markets in the world.

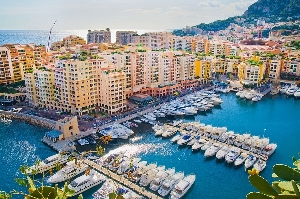

According to the 2024 Knight Frank Wealth Report, $1 million would only buy 16 square meters of prime property in Monaco, the tiny but extremely wealthy country perched on the Mediterranean coast between Italy and France.

For context, a typical studio apartment or a smaller one-bedroom is around 500 square feet, according to Apartment List. That’s roughly 46 square meters. So, in other words, $1 million would theoretically allow one to buy only a fraction of a typical apartment in Monaco.

Over the past decade, the number of resale properties sold with prices above 10 million euros, which is around $10.8 million, increased by more than 300% in Monaco, according to a report from Savills.

Over the last year, the share of Monaco properties sold above that price point was more than 50%.

In Hong Kong, $1 million would only buy 22 square meters of prime property; in Singapore, it would get you 32 square meters.

The median price of a home in Hong Kong was $1.16 million in 2023, while in Singapore it was $1.2 million, according to a report from the Urban Land Institute Asia Pacific Centre for Housing. Singapore also offers government-subsidized housing, which is much cheaper, at a median price of $409,000.

That $1 million would go much further in New York or Los Angeles, two of the most expensive American real-estate markets, where one could buy 34 and 38 square meters of prime property, respectively, Knight Frank found.

The Knight Frank Wealth Report, released Wednesday, focused on movements in luxury prices across the world’s top residential markets.

“There is significant variation in prime prices across luxury residential markets, which often surprises buyers,” the report said.

“Prime prices in Dubai may sit 134% higher than at the start of the pandemic, but they are still noticeably lower than in more established markets,” the authors noted. “Here, US$1 million buys 91 [square meters], four times the equivalent in Hong Kong.”

But for the world’s wealthiest, or top 1%, buying such homes is likely a cakewalk. In the U.S., those in the top 1% have a net worth of roughly $5.8 million or more, according to the report.

Business News of Sunday, 3 March 2024

Source: marketwatch.com