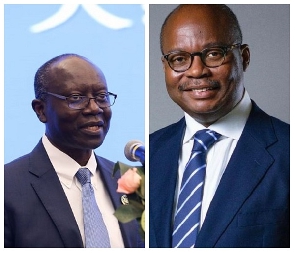

Following the approval of Ghana's loan request for a $3 billion bailout from the International Monetary Fund, Finance Minister, Ken Ofori-Atta and Bank of Ghana Governor, Dr Ernest Addison had earlier wrote to Kristalina Georgieva, the IMF Managing Director back on May 1, 2023 to expedite the country's request for a bailout package.

On May 19, 2023, the Bretton Woods institution credited the first tranche loan facility consisting of $600 million into the Central Bank's account. The funds are expected to support Balance of Payment transactions and stabilise macroeconomic indicators.

See the letter below:

Dated: May 1st, 2023

Dear Madame Georgieva:

Following three years of strong and sustained macroeconomic performance, Ghana has been hit by major external shocks over the period 2020-22. These have heightened pre-existing vulnerabilities and pushed the economy into crisis. In particular, the twin impacts of the COVID-19 pandemic and the war in Ukraine have weakened public finances significantly and contributed to a rapid and steep increase in inflation. These shocks have also been compounded by a tightening of financing conditions both globally and locally, which in turn, have compromised efforts at attaining fiscal and debt sustainability. These developments have eventually resulted in a loss of international market access and increasing difficulties in rolling over maturing domestic public debt instruments, thus accelerating the negative feedback loop of decreasing international reserves, Cedi depreciation, rising inflation, and plummeting investor confidence, and making our public debt unsustainable.

Faced with this difficult situation, we have laid out a strong program to restore macroeconomic stability and lay the foundation for strong and more inclusive growth. Key areas of focus of our Post-Covid-19 Program for Economic Growth (PC-PEG) include ensuring public finance sustainability while protecting the vulnerable, bolstering the credibility of monetary and exchange rate policies to reduce inflation and rebuild external buffers, preserving financial sector stability, and taking extraordinary steps to promote entrepreneurship and private investments (domestic and FDI) to establish a dynamic export-driven economy and accelerate growth as a strong platform for the AfCFTA, while also ensuring further improvements in governance and transparency of the public sector.

We have already taken several important steps as part of the PC-PEG. Parliament has approved the 2023 budget which has jump-started our ambitious and frontloaded fiscal consolidation program, including through ambitious revenue measures. We have also launched and now implementing a comprehensive debt operation, which, together with our fiscal program, will put public finances and debt back on a sustainable path. We have taken steps to strengthen expenditure commitments controls. We have raised electricity tariffs as an essential step toward a full cost-recovery pricing regime, with a view to reducing the energy sector financial shortfall and ensuring the financial sustainability of the energy sector. The government and the Bank of Ghana have signed a Memorandum of Understanding (MOU) to end monetary financing to help reduce inflation. The Bank of Ghana has also tightened its monetary policy stance significantly in recent months and is committed to maintaining the appropriate policy stance to help steer inflation back to the medium-term target band of 8 ± 2 percent. As part of our efforts to enhance fiscal transparency and public sector accountability, the Auditor General has prepared and published an audit report on COVID-19 spending.

To support our objectives, we wish to request a 36-month arrangement under the Extended Credit Facility (ECF), with access at 304 percent of our SDR quota (SDR 2.242 billion) to be disbursed as budget support. Along with support from development partners and financing provided through the comprehensive debt restructuring that has been launched, the proposed financing arrangement will cover our fiscal and external financing gaps as we embark on a multi-year adjustment effort.

We believe that the policies and actions set out in the attached Memorandum of Economic and Financial Policies (MEFP) underpinned by the PC-PEG will enable us to achieve our program objectives. The proposed arrangement will be monitored through a series of quantitative performance criteria and indicative targets. It also includes a series of prior actions and structural benchmarks covering reform areas that are critical to bolster macro-economic performance and continuous performance criteria related to exchange restrictions and multiple currency practices in the context of the Article VIII. The government is committed to providing the IMF with information on the implementation of the agreed measures and the execution of the program, as provided for in the attached Technical Memorandum of Understanding (TMU).

Should further measures be necessary, we will consult in advance with the IMF on their adoption, in accordance with applicable IMF policies. We are committed to working closely with IMF staff to ensure that the program is successful, and we will provide the IMF with the relevant information necessary for monitoring our progress.

We fully recognize the importance of completing an updated safeguards assessment of the Bank of Ghana before completion of the first review under the ECF. An IMF mission to conduct the safeguards assessment took place over March-April 2023. The Bank of Ghana provided Fund staff with all necessary information in preparation for that mission.

Consistent with our commitment to transparency in Government operations, we agree to the publication of all the documents submitted to the IMF Executive Board in relation to this request.

Sincerely yours,

/s/ Kenneth Ofori-Atta Minister for Finance /s/ Ernest Kwamina Yedu Addison Governor, Bank of Ghana Cc: Secretary to the President, Jubilee House, Accra

Watch the latest edition of BizTech and Biz Headlines below:

MA

Business News of Monday, 22 May 2023

Source: www.ghanaweb.com